|

• The finishing touch of the Pre-Feasibility Find out about establishes Protection Metals’ Wicheeda Undertaking as one of the complex undeveloped uncommon earth initiatives |

|

• The Wicheeda Undertaking economics of pre-tax NPV at 8% of US$1.8 billion and IRR of 24.6% with after-tax payback of three.7 years are powerful. |

|

• The breakeven value of NdPrO1 for the challenge is US$67.60/kg (for IRR of 0). The working coins breakeven value of NdPrO is US$37.42/kg. |

|

• The Wicheeda Undertaking will be on one?s feet out within the Western uncommon earth trade on account of the outstanding purity of its ultimate product, which in flip will allow it |

VANCOUVER, BC, Feb. 18, 2025 /PRNewswire/ – Protection Metals Corp. (“Defense Metals” or the “Company”; (TSXV: DEFN) (OTCQB: DFMTF) (FSE:35D) is happy to let fall the result of its free Pre-Feasibility Find out about (PFS) regarding the on-going building of its 100%-owned Wicheeda Uncommon Earth Part (REE) attic situated in British Columbia (BC), Canada.

All quantities herein are in United States greenbacks, until in a different way mentioned.

Man de Selliers, Govt Chairman, mentioned: “The positive results of our Pre-Feasibility Study confirm the strategic importance of the Wicheeda Project at a time when North America and Europe are prioritizing financial resilience and provide chain safety for important minerals.

“With NdPr being essential to electric vehicles, renewable energy, and advanced defense technologies, the Wicheeda Project represents a unique opportunity to establish a reliable, Western-aligned supply of these vital materials, reducing reliance on foreign sources and importantly helping to secure economic security.

“Our Wicheeda uncommon earth challenge is among the maximum complex in both North America or Europe that’s not but in manufacturing, positioning it as a important, near-term method to meet the rising calls for for Western-aligned delivery chains.

“As we move forward, we remain committed to responsible development policies and practices, along with strong partnerships that collectively will unlock the full economic and strategic value of this asset for all stakeholders and rightsholders.”

Wicheeda Undertaking PFS Highlights

Powerful Economics

- Pre-tax internet provide price (NPV) of $1.8 billion and after-tax NPV of $1.0 billion, at an 8% cut price price.

- Next-tax payback length of three.7 years from the beginning of manufacturing.

- Pre-tax inner price of go back (IRR) of 24.6%, and after-tax IRR of 18.9%.

- Preliminary Capital Value (CAPEX) of $1.4 billion.

- Unhidden-pit manufacturing of 15 years (aside from pre-production) feeding a 5,000 tonne in keeping with life (tpd) flotation concentrator.

- Money working prices moderate $37.42/kg NdPrO (identical contained1) recovered.

- Moderate working margin of 71% (EBITDA / Income).

Prime-Grade REE Mineral Storehouse Benefit

- Protection Metals’ Wicheeda REE attic is situated in a Tier 1 mining jurisdiction.

- The Wicheeda Undertaking has logistical and infrastructure benefits.

- The challenge’s reserves assistance a 15-year Date-of-Mine (LOM) with a mean annual manufacturing of 31,900 tonnes (t) of General Uncommon Earth Oxide (TREO)2 in pay attention, turnover roughly 5,200 t of TREO in a high-value blended uncommon earth carbonate (MREC) later the removing of cerium (Ce) and lanthanum (L. a.).

- Distinctive mineralogy of the Wicheeda REE attic lets in for the manufacturing of some of the highest-grade flotation REE mineral concentrates on the earth at remarkable fix ranges.

Prime-Grade Mineral Pay attention Benefit

- LOM manufacturing of a high-grade flotation mineral pay attention, containing a mean 50% TREO (brittle foundation) at 81% fix over the preliminary 8 years.

- The mineral pay attention shall be processed at Protection Metals’ personal hydrometallurgical and solvent extraction (SX) judicial separation procedure amenities.

Prime-Price Saleable Blended Uncommon Earth Carbonate Product

- All the L. a. and many of the Ce shall be got rid of all over the SX procedure, making a value-added ultimate MREC product.

- The basket price of the MREC is derived from uncommon earth components important to high-growth everlasting magnet packages; neodymium and praseodymium (87.3 wt%), dysprosium, (0.6 wt%), and terbium (0.2 wt%) of contained TREO. Alternative minor REE constituents aren’t thought to be within the basket price.

Protection Metals has taken a centered and conservative method to all prices and inputs in order a practical and compelling PFS that it believes maximizes the scope and scale of its Wicheeda Undertaking over the long run.

The PFS comprises an preliminary confirmed and possible mineral hold estimate that helps a 15-year, open-pit mining operation (aside from pre-production) that may build ore feed for a 5,000 tpd flotation plant. The flotation plant will build a high-grade REE mineral pay attention that may feed hydrometallurgical and SX procedure amenities to build a value-added MREC product.

Mark Tory, President and CEO of Protection Metals, commented: “We are thrilled to announce the successful completion of an independent Pre-Feasibility Study for our Wicheeda Rare Earth Deposit, marking a major milestone in its development. The PFS, conducted in collaboration with renowned global experts Hatch and SRK, demonstrates the strong potential of the Wicheeda Project as a reliable and sustainable source of critical rare earth elements that are essential to advance energy technologies, manufacturing, and defence applications.

“The high-grade mineral pay attention produced by way of the Wicheeda Undertaking will go through hydrometallurgical and solvent extraction processing, and in step with our flowsheet design will allow us to build a high-value Blended Uncommon Earth Carbonate product, because of the really extensive removing of lanthanum and cerium.

“With a pre-tax IRR of 24.6% and a pre-tax NPV of US$1.8 billion, our PFS confirms the robust economics this project has to offer. These results position the Wicheeda Project as one of the most compelling rare earth projects in North America or Europe. Given the increasing geopolitical tensions affecting rare earth supply chains, there is significant potential for rare earth prices to rise, further enhancing Wicheeda’s value and maximizing returns for our shareholders.

“Having a look forward, we will be able to center of attention on optimizing the challenge’s design to maximise operational potency and in the long run shareholder returns. Moreover, we will be able to have interaction with possible strategic companions to assistance the challenge’s progress and building.

“Now is the ideal time for a North American rare earth company to advance toward building a new mine and processing facilities. We are moving forward with our regulatory engagement and continue to work closely with the project’s Indigenous rightsholders to expedite the approval process and bring this critical project to fruition.”

|

___________________________ |

|

1 Neodymium-Praseodymium oxide (NdPrO) and General uncommon earth oxide (TREO) equivalents are reported on this report by way of conference. Within the ultimate MREC product, the uncommon earths shall be provide as carbonates (RE2(CO3)3), and within the feed and flotation pay attention they’re going to be found in a number of species. For reporting functions, the uncommon earth content material is transformed to the oxide identical. |

|

2 TREO accounts for all 15 uncommon earth oxides throughout the attic; alternatively, for monetary modeling functions most effective Nd, Pr, Tb and Dy are assigned financial price. |

Wicheeda Undertaking – Key Parameters

The challenge stage monetary research used to be carried out on a 2025-dollar foundation with out inflation.

Desk 1 – Bottom Case Economics

|

Monetary Metrics |

Devices |

Bottom Case |

|

Pre-tax NPV @ 8% |

$M |

1,803 |

|

Next-tax NPV @ 8% |

$M |

992 |

|

Pre-tax IRR |

% |

24.6 |

|

Next-tax IRR |

% |

18.9 |

|

Undiscounted Next-tax Undertaking Cashflow (LOM) |

$M |

2,672 |

|

Next-tax payback length from get started of manufacturing |

Years |

3.7 |

|

Prices and Benefit |

||

|

Preliminary capital expenditure |

$M |

1,440 |

|

Moderate annual working charge |

$M in keeping with annum |

165 |

|

Moderate annual working charge |

$/kg NdPrO identical in MREC |

37.42 |

|

MREC moderate value |

$/kg NdPrO identical content material in MREC |

136.30 |

|

Date of mine rude earnings |

$M |

9,030 |

|

Working (EBITDA) margin |

% |

71 |

|

Manufacturing Metrics |

||

|

Mine date (aside from pre-production) |

Years |

15 |

|

Most mining manufacturing price |

Mtpa |

8.7 |

|

Date of mine strip ratio |

Misspend: Ore |

3.3:1 |

|

Date of mine TREO grade |

% TREO in mill feed |

2.4 |

|

Date of mine flotation pay attention |

Thousand tonnes in keeping with annum (ktpa) brittle |

62.5 |

|

Pay attention grade |

% TREO (brittle) |

50 |

|

Date of mine NdPrO contained in MREC |

ktpa NdPrO identical |

4.4 |

|

Date of mine NdPrO % of TREO in MREC |

% NdPrO identical |

87 |

The PFS used to be carried out by way of Hatch Ltd. (Hatch) and SRK Consulting (Canada) Inc. (SRK). The Hatch and SRK Certified Particular person (QP) authors ascertain that the Wicheeda Undertaking PFS disclosure meets the criteria established by way of the Canadian Securities Directors’ Nationwide Device 43-101 – Usual of Disclosure for Mineral Tasks (NI 43-101).

The fantastic month of the PFS is February 7, 2025, and the Corporate expects to record a NI 43-101 technical file in relation to the PFS on SEDAR+ inside of 45 days of this information let fall.

Wicheeda Undertaking Evaluate

Beneficial Mineralogy Chief to Beneficial Metallurgy

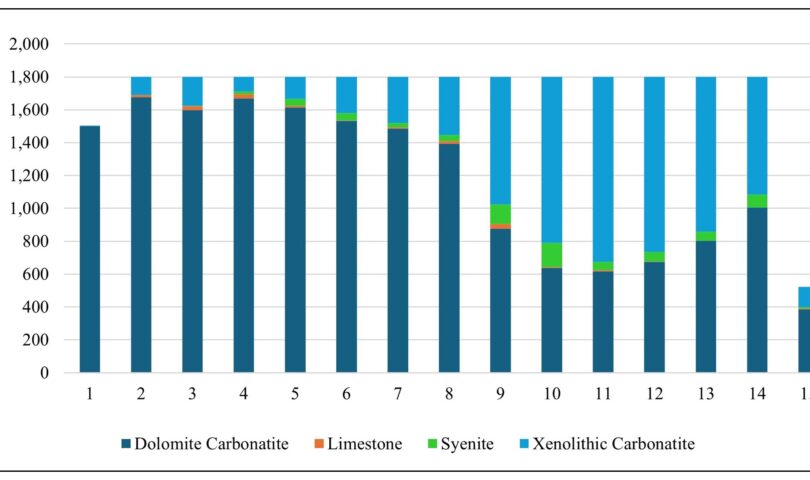

The Wicheeda REE attic is characterised by way of 3 primary REE-bearing lithologies: dolomite carbonatite (DC), which is the dominant lithology, xenolithic carbonatite, and syenite. Limestone is the foremost misspend rock lithology.

The major REE-bearing minerals are bastnäsite, monazite, synchysite and parisite. The coarse grain dimension of Wicheeda’s REE mineralization supplies important metallurgical benefits, making an allowance for enhanced mineral liberation and stepped forward judicial separation from gangue minerals all over comminution and larger flotation potency. Those components all assistance environment friendly and cost-effective REE fix and jointly govern to the manufacturing of a LOM high-grade REE pay attention (averaging 50% TREO) that contributes to the Wicheeda Undertaking’s financial viability.

Mine Making plans

Desk 2 – PFS Mine Plan Abstract

|

Mine Manufacturing Metrics |

Unit |

Pre-prod |

Yrs 1-8 |

Yrs 9-15 |

LOM |

|

Goal Annual Throughput |

Mt/a |

– |

1.8 |

1.8 |

1.8 |

|

General Subject matter Motion |

Mt |

11.2 |

65.2 |

33.3 |

109.7 |

|

General Ore |

Mt |

0.1 |

14.6 |

10.8 |

25.5 |

|

General Misspend |

Mt |

11.0 |

50.0 |

21.6 |

84.2 |

|

Strip Ratio |

misspend: ore |

77.0:1 |

3.5:1 |

2.1:1 |

3.3:1 |

|

Moderate Ore Grade |

% TREO |

2.32 |

2.80 |

1.92 |

2.43 |

|

General Flotation Pay attention Produced |

Mt brittle |

– |

0.632 |

0.306 |

0.94 |

|

Design Flotation Pay attention Grade |

% TREO |

50 |

50 |

50 |

50 |

|

Moderate Flotation Plant Medication |

% |

– |

80.9 |

69.3 |

76.7 |

The Wicheeda Undertaking shall be advanced as an open-pit mining operation. Within the first 8 years of ore manufacturing, near-surface, most commonly high-grade DC mineralization shall be mined as indicated within the Determine 1 appearing ore lithology over day. Mining charges will length from 4 to 9 million-tonnes in keeping with annum (Mtpa) over the 15-year mine date (aside from pre-production).

Mined ore shall be overwhelmed at a facility close to the pit and transported by means of conveyor to maintain a 1.8 Mtpa mill feed to the on-site flotation plant. Misspend rock shall be positioned in a misspend rock storagefacility facility (WRSF) adjoining to the pit.

The flotation plant will build a high-grade uncommon earth mineral pay attention averaging 50% TREO. The flotation plant flowsheet comprises crushing, semi-autogenous and ball mill grinding, rougher and scavenger flotation and 3 levels of cleaner flotation at increased temperatures to build a last flotation pay attention.

The Wicheeda Undertaking envisages dewatering tailings the usage of filter out press generation and storing the filtered subject matter in a filtered tailings storagefacility facility (FTSF) situated west of Wichcika Creek. It’s going to bundle each flotation tailings and hydrometallurgical too much, with a liner machine and H2O control pool to govern environmental have an effect on.

The high-grade, filtered mineral pay attention shall be transported off-site, roughly 45 kilometers (km) by way of truck, to Endure Puddle for hydrometallurgical and SX processing to build a top of the range MREC product.

Hydrometallurgy with Lanthanum and Cerium Removing by way of Solvent Extraction

All through hydrometallurgical processing, the flotation mineral pay attention will first go through acid baking with concentrated sulphuric acid (1.1 t/t pay attention) at about 300˚C, changing the uncommon earths into water-soluble sulphates, which voluntarily dissolve all over a next H2O leach procedure. The ensuing leachate will upcoming be purified ahead of being despatched to the SX unit for the removing of L. a. and Ce to permit manufacturing of MREC with enhanced financial price.

The SX operations will make use of a unmarried, usual solvent extraction circuit the usage of an acidic extractant in a kerosene-based diluent: to free L. a. and Ce from the alternative REEs.

The low-value L. a. and Ce will in large part be eradicated and one at a time brought about and disposed of in a misspend storagefacility facility supplied for the hydrometallurgical procedure (with possible to be recovered must a marketplace form for those components). The extra worthy REEs shall be retained, together with the magnet-metal REEs: praseodymium (Pr), neodymium (Nd), terbium (Tb) and dysprosium (Dy).

Desk 3 – Hydrometallurgical Plant Metrics

|

Merchandise |

Unit |

Yrs 1-8 |

Yrs 9-15 |

LOM |

|

Flotation pay attention feed |

ktpa |

80.4 |

44.7 |

63.7 |

|

MREC manufacturing (TREO identical) |

ktpa |

6.3 |

3.8 |

5.2 |

|

NdPrO (identical) |

ktpa |

5.4 |

3.2 |

4.4 |

|

Big REO (identical)3 |

ktpa |

0.8 |

0.5 |

0.7 |

|

Hydrometallurgical Plant Medication |

% NdPrO |

93.4 |

93.4 |

93.4 |

Next the L. a. and Ce are got rid of, the difference REEs are brought about as a MREC.

The benefit of the SX procedure is {that a} higher-quality, higher-value MREC product is produced, containing 87% NdPr oxide and 11% big uncommon earth oxides together with worthy Dy and Tb. Removing of the L. a. and Ce reduces the cluster of MREC to be produced by way of an element of six with none lack of the worthy NdPr. This no longer most effective lets in for transportation and judicial separation charge financial savings but in addition creates a extra fascinating product for downstream stop customers and REE separators.

|

_____________________________ |

|

3 For the needs of this report, Big REO refers back to the oxides of samarium (Sm), europium (Ecu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), holmium (Ho), erbium (Er), thulium (Tm), ytterbium (Yb), lutetium (Lu), and yttrium (Y). Simplest Tb and Dy contributions have been thought to be within the product price calculations. |

Proximity to Current Infrastructure

The Wicheeda REE attic is roughly 80 km northeast of the close by town of Prince George, British Columbia. The attic location supplies finest get right of entry to to infrastructure, because the web site is offered by means of an all-weather gravel highway that connects to British Columbia Freeway 97. Proximity to main B.C. Hydro hydroelectric energy strains, a herbal gasoline pipeline, and the Canadian Nationwide Railway series additional beef up the challenge’s logistical benefits.

Prince George (agglomerated family ~ 95,000) serves as a regional hub, supporting oil and gasoline, forestry, hydropower and mining industries and do business in a talented personnel and very important services and products. Day-to-day business breeze provider is to be had between Prince George and main Canadian global airports. Additionally, the port of Prince Rupert, the nearest main North American port to Asia is situated about 500 km to the west and out there by way of rail and highway.

Energy

The Wicheeda Undertaking’s energy delivery is predicted to return from a brandnew high-voltage transmission series (1L 365) situated west of the challenge web site which connects to the B.C. Hydro 500 kV series. Value estimates worn within the PFS are in accordance with trade benchmarks.

Transportation

Upgrading the prevailing forestry highway from Endure Puddle will facilitate get right of entry to to the challenge web site.

The Canadian Nationwide Railway (CNR) shall be remarkable within the delivery of Wicheeda Undertaking procedure plant reagents and consumables. The CNR handles over 50% of all Canadian chemical compounds manufacturing and is the one rail service servicing 3 main petrochemical facilities in North The usa: the Alberta Heartland, the U.S. Gulf Coast and southwestern Ontario. The CNR series that passes via Endure Puddle is high-capacity rail series that still services and products the port amenities at Prince Rupert, BC.

Undertaking Infrastructure

The mining challenge segment shows a topography and geography preferably suited to building. The various park supplies alternatives to reduce earthwork necessities and facilitates the improvement of a H2O control plan which maintains herbal drainage patterns.

H2O Provide

All abundance H2O on the mine web site shall be directed to the touch H2O pool on the processing plant for procedure H2O recirculation or remedy and discharge.

Desk 4 – Wicheeda Undertaking Capital Expenditure Estimates

|

Division |

Capital Prices ($M) |

||||

|

Preliminary |

Maintaining |

Closure |

Publish Closure |

General |

|

|

Mining |

99.2 |

57.9 |

– |

– |

157.2 |

|

Flotation Plant and Infrastructure |

450.9 |

– |

– |

– |

450.9 |

|

Hydrometallurgical and SX Vegetation |

614.5 |

– |

– |

– |

614.5 |

|

Mine Tailings |

19.8 |

45.7 |

– |

– |

66.5 |

|

Hydrometallurgical Misspend |

10.7 |

14.0 |

– |

– |

24.7 |

|

Touch H2O Puddle |

11.8 |

– |

– |

11.8 |

|

|

Mine Website H2O Control |

1.6 |

– |

– |

– |

1.6 |

|

Mine Website H2O Remedy |

10.0 |

– |

– |

– |

10.0 |

|

Hydrometallurgical H2O Remedy |

6.6 |

– |

– |

– |

6.6 |

|

Closure |

– |

– |

57.4 |

325.1 |

382.5 |

|

Contingency |

214.8 |

15.3 |

7.2 |

40.6 |

277.9 |

|

General |

1,439.8 |

133.0 |

64.5 |

365.8 |

2,003.0 |

Value estimates don’t believe charge escalation because of the imposition of brandnew price lists, counter-tariffs, import and/or export tasks or alternative matching fees acceptable to uncooked, semi-finished or carried out fabrics and/or alternative merchandise.

Desk 5 – Wicheeda Undertaking Working Prices Estimates

|

Division |

LOM ($M) |

LOM avg ($M/y) |

LOM ($/kg NdPrO |

|

Mining |

537 |

35.8 |

8.09 |

|

Flotation Plant |

724 |

48.3 |

10.91 |

|

Hydrometallurgical Facility |

995 |

66.3 |

15.02 |

|

Concentrator & Hydrometallurgical Facility Basic & Management |

88 |

5.8 |

1.32 |

|

Mine Website Tailings |

94 |

6.3 |

1.42 |

|

Hydrometallurgical Misspend |

20 |

1.4 |

0.31 |

|

Touch H2O Puddle |

2 |

0.2 |

0.04 |

|

Mine Website H2O Remedy |

11 |

0.7 |

0.16 |

|

Hydrometallurgical H2O Remedy |

8 |

0.5 |

0.12 |

|

General |

2,479 |

165.3 |

37.42 |

Uncommon Earth Markets and Worth Forecast

The Uncommon Earth Marketplace

In keeping with Adamas Knowledge Inc. (Adamas), world Neodymium-Iron-Boron (NdFeB) magnet intake grew by way of 13% in 2023, and initiatives call for will stand by way of 12% in 2024 to 231,371 t. This progress has been in large part pushed by way of passenger and business electrical automobiles (EV) traction motors, breeze energy turbines and shopper electronics.

Adamas reviews that the magnet trade, which is dependent upon Nd, Pr, and, for high-end packages, Dy and Tb, is the biggest shopper of uncommon earths by way of quantity, accounting for 49% of world call for in 2023. On the other hand, in price phrases, uncommon earth everlasting magnets have lengthy been the dominant marketplace. In 2023, magnet packages represented over 95% of the full uncommon earth marketplace price.

Having a look forward, Adamas initiatives that world call for for NdFeB magnets will build up at a compound annual progress price of 8.7% to achieve 606,792 t by way of 2035 and 881,396 t in 2040. The predicted largest calls for riding progress come from robotics, complex breeze mobility, business EV traction motors and passenger EV traction motors, reinforcing their important function in complex applied sciences and the power transition.

Uncommon Earth Costs

Uncommon earth costs had been extremely unstable in recent times, pushed by way of rising call for for power and mobility applied sciences, the COVID pandemic, in addition to geopolitical components.

Adamas has advanced a Bottom Case pricing state of affairs that accounts for supply-demand modeling and expects that the week of uncommon earths call for (no less than in relation to, Nd, Pr, Dy and Tb) shall be extra powerful, extra resilient and no more delicate to worth than call for of the hour and provide, which continues to be in large part pushed by way of shopper and legacy car packages.

Adamas believes that from 2032 via 2040 Protection Metals may be expecting to obtain a value for its MREC equivalent to 95% of the uncommon earth oxide price it comprises (price in accordance with China home costs, aside from VAT).

Adamas expects the cost of NdPr oxide to extend from a mean of $63/kg this yr to $70-110/kg within the late-2020s. In a rational marketplace, it might be expecting those value will increase to urge funding in brandnew manufacturing efficiency. On the other hand, owing to the lengthy govern instances to form brandnew uncommon earth provides and the deficit of complex, financially dedicated initiatives within the pipeline lately, Adamas sees possible for prevalent deficits to push costs above required inducement ranges (estimated at $100-150/kg in the long run).

Given the tall quantities of NdPr within the ultimate MREC later disposing of Ce and L. a., the typical MREC value in keeping with kg for the Wicheeda Undertaking is $70.4/kg of MREC, which is the identical of $116.5/kg of contained TREO and the identical of $136.3/kg of contained NdPrO.

Monetary Research

The predicted challenge cashflows have been modelled the usage of a easy discounted cash-flow fashion. A cut price price of 8% used to be worn. The fashion makes use of nominal cashflows and prices and is configured for annual classes. An trade price of 1.40 CAD/USD used to be worn for reporting any CAD values worn within the PFS. A relentless value of $133/kg NdPrO used to be carried out and is in accordance with the Adamas long run forecast.

Desk 6 – Money Current Abstract

|

Merchandise |

Undiscounted LOM ($M) |

Undiscounted Unit Moderate |

Discounted LOM ($M) |

|

Rude Income |

9,030 |

136.33 |

4,536 |

|

Working Prices |

(2,479) |

(37.42) |

(1,208) |

|

Product Transportation |

(26) |

(0.39) |

(13) |

|

Royalties |

(90) |

(1.36) |

(45) |

|

EBITDA |

6,435 |

97.15 |

3,269 |

|

Adjustments in Web Running Capital |

– |

– |

(80) |

|

Preliminary Capital Value |

(1,440) |

(21.74) |

(1,275) |

|

Maintaining Capital Value |

(133) |

(2.01) |

(70) |

|

Closure and Reclamation Bond Value |

(430) |

(6.50) |

(41) |

|

Royalty buy-out |

(1) |

(0.01) |

(1) |

|

Pre-Tax Money Current |

4,431 |

66.90 |

1,803 |

|

BC Mineral Tax |

(604) |

(9.12) |

(269) |

|

Company Tax |

(1,155) |

(17.44) |

(542) |

|

Next-Tax Money Current |

2,672 |

40.33 |

992 |

The PFS estimates general LOM taxes paid of $1.8 billion together with $604 million to the Province of British Columbia and $1.2 billion to the Executive of Canada, implying an estimated tax price on taxable source of revenue of roughly 40%.

Sensitivity Research

NPV @ other cut price charges

Desk 7: NPV sensitivity to cut price price

|

Bargain price (%) |

5 % |

8% (bottom) |

10 % |

15 % |

|

Pre-tax NPV ($M) |

2,582 |

1,803 |

1,403 |

694 |

|

Next-tax NPV ($M) |

1,514 |

992 |

722 |

242 |

NPV and IRR sensitivity to the itemized components are illustrated within the graphs which observe:

- MREC value (considerably NdPr)

- CAPEX

- OPEX

Protection Metals evaluated pricing reviews from Adamas and Argus Media (Argus). The Corporate believes it used to be extra suitable to worth Adamas for comparison with friends who’ve worn the similar pricing method. This comprises MP Fabrics Corp. which reference the Adamas pricing of their February 22, 2024, EDGAR submitting on the subject of technical file for his or her Mountain Move mine. Argus had two eventualities, the inducement value state of affairs used to be 6.8% greater than Adamas bottom case pricing and the conservative case used to be 18.3% not up to the Adamas bottom case pricing.

Environmental, Social, and Regulatory Engagement

Protection Metals is dedicated to keeping up tall environmental, social, and governance (ESG) requirements time responsibly progressing the improvement of the Wicheeda Undertaking. The regulatory jurisdiction has embedded requirements in relation to the environmental evaluate and allowing processes that align with ESG rules, together with the honor of circumstance trade in challenge making plans and have an effect on evaluate, biodiversity tests, social have an effect on analysis and stakeholder engagement and rightsholder session. Many important baseline research had been initiated to assure a background working out of environmental, social and cultural values. Spare environmental, social and cultural research shall be finished to serve challenge design refinements and exit environmental evaluate and allowing processes.

Protection Metals and the McLeod Puddle Indian Band (MLIB) have signed a Co-Design Word of honour, formalizing their partnership to combine MLIB’s views into all challenge stages, from technical and engineering issues to social and environmental making plans. Protection Metals is dedicated to ongoing collaboration with rightsholders and stakeholders, prioritizing their pursuits and dealing in opposition to consensus.

The Wicheeda Undertaking is essential to British Columbia’s transition to wash power. Protection Metals maintains related communique with the BC Vital Minerals Place of job, a central authority frame that fosters the province’s important mineral sector. Thru this dating, Protection Metals is supplied with devoted regulatory procedure support and imaginable investment assistance.

Mineral Reserves and Sources Estimates

Mineral Reserves

The mineral hold estimate for the Wicheeda Uncommon Earth Part Storehouse has been ready for Protection Metals as phase of the 2025 Pre-Feasibility Find out about (PFS). This mineral hold estimate has been ready in response to the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Requirements on Mineral Sources and Mineral Reserves followed by way of CIM Council in Might 2014.

The mineral reserves respective of the i’m free pit are in accordance with Gradual and Indicated mineral sources which were recognized as being economically extractable and which incorporate mining losses and mining misspend dilution. The mineral reserves come with 25.5 million tonnes (Mt) of mineable ore from one i’m free pit at an moderate grade of two.43% TREO. The mineral hold comprises variable mining dilution, and it’s calculated later 1% ore loss.

A abstract of the skin mineable mineral reserves by way of rock kind and hold classification is proven in Desk 8.

Desk 8 – Abstract of the Mineral Reserves (as of February 7, 2025)

|

Mineral Store |

Rock Kind |

Tonnes |

TREO |

Pr6O11 |

Nd2O3 |

Tb4O7 |

Dy2O3 |

|

kt |

% |

ppm |

ppm |

ppm |

ppm |

||

|

Confirmed |

Dolomite Carbonatite |

5,377 |

2.97 |

1,152 |

3,135 |

12 |

35 |

|

Limestone |

11 |

2.01 |

858 |

2,359 |

12 |

40 |

|

|

Syenite |

42 |

1.45 |

582 |

1,681 |

11 |

39 |

|

|

Xenolithic Carbonatite |

258 |

1.74 |

700 |

2,060 |

11 |

37 |

|

|

General |

5,688 |

2.90 |

1,127 |

3,074 |

12 |

35 |

|

|

Possible |

Dolomite Carbonatite |

12,178 |

2.86 |

1,122 |

3,071 |

12 |

34 |

|

Limestone |

139 |

1.39 |

563 |

1,600 |

10 |

38 |

|

|

Syenite |

639 |

1.25 |

503 |

1,483 |

8 |

26 |

|

|

Xenolithic Carbonatite |

6,820 |

1.42 |

585 |

1,717 |

9 |

30 |

|

|

General |

19,775 |

2.30 |

913 |

2,543 |

10 |

32 |

|

|

General |

Dolomite Carbonatite |

17,554 |

2.89 |

1,131 |

3,091 |

12 |

34 |

|

Limestone |

150 |

1.44 |

585 |

1,655 |

10 |

38 |

|

|

Syenite |

681 |

1.26 |

508 |

1,495 |

8 |

27 |

|

|

Xenolithic Carbonatite |

7,078 |

1.44 |

589 |

1,730 |

9 |

30 |

|

|

General |

25,462 |

2.43 |

961 |

2,661 |

11 |

33 |

Mineral Reserves Notes:

|

• The fantastic month of the Wicheeda Uncommon Earth Part Storehouse Mineral Store is February 7, 2025. |

|

• Greenback values herein mentioned are United States Bucks (US$) |

|

• Mineral Reserves are reported assuming the costs supplied from Adamas indexed under: |

|

• NdPr Oxide 132.70 $/kg REO |

|

• Tb4O7 1362.83 $/kg REO |

|

• Dy2O3 442.48 $/kg REO |

|

• Mineral Reserves are outlined throughout the ultimate pit design guided by way of pit shells derived from the optimization instrument, GEOVIA Whittle™ |

|

• Trim-off grade is in accordance with the price components generated in each and every ban. The earnings and indistinguishable prices range in accordance with the composition of various components |

|

• The bottom mining prices are assumed to be $5.00/t. The mining prices range founded by way of the bench and intensity of the pit. The typical mining prices for the date |

|

• Processing prices include flotation plant charge on the mine web site and a hydrometallurgical/solvent extraction (hydrometallurgical) plant this is off the mine |

|

• Basic and management prices of the mine web site is $3.67/t for ore milled. |

|

• Tailings control and storagefacility charge is $6.55/t of ore. |

|

• Off-site charge (transportation) is $87.76/t of precipitate merchandise produced. |

|

• Processing fix is calculated the usage of please see system: |

|

• Flotation fix for TREO = -11.183*TREO^2 + 67.831*TREO – 20.42194%. For ore above 3% TREO, the flotation fix is about to 82.4%. For grade |

|

• Flotation fix for TREO upcoming is multiplied by way of 0.995, 0.996, 0.734, 0.636 for Pr, Nd, Tb, Dy respectively to calculate the respective flotation fix |

|

• Hydrometallurgical fix for Pr, Nd, Tb, Dy are 0.932, 0.935, 0.802, 0.734 respectively. |

|

• A 95% payability has been carried out to the general hydrometallurgical product. |

|

• Mining dilution varies in accordance with the mining zone. The typical mining dilution is calculated to be 2.9%, for the ore dropped at the mill. Tonnages reported |

|

• A 1% ore loss has been carried out to the full hold in each and every bench. |

|

• Figures are rounded to the best stage of precision for the reporting of mineral reserves. Because of rounding, some columns or rows won’t sum as proven. |

|

• The total strip ratio (Misspend:Ore – the quantity of misspend mined for each and every tonne of ore) is 3.34. |

|

• The mineral hold is mentioned as diluted brittle metric tonnes. |

|

• The mine plan bedrock the mineral reserves has been ready by way of SRK Consulting (Canada) Inc. |

|

• The TREO grade encompasses 15 uncommon earth components provide within the attic |

|

• The estimate of Mineral Reserves could also be materially suffering from environmental, allowing, felony, name, taxation, sociopolitical, advertising and marketing, or alternative related problems. |

The Certified Particular person, Dr. Anoush Ebrahimi, does no longer know of any felony, political, environmental, or alternative dangers that would materially impact the prospective building of the mineral reserves. Dr. Ebrahimi individually inspected the Wicheeda Undertaking on October 26, 2021.

Mineral Sources

The Mineral Useful resource estimate for the Wicheeda Uncommon Earth Part Storehouse has been ready for Protection Metals as phase of the 2025 Pre-Feasibility Find out about (PFS). This Mineral Useful resource estimate has been ready in response to the CIM Definition Requirements followed Might 2014.

The Mineral Sources mentioned under are constrained inside of an optimized pit shell to meet Affordable Possibilities of Eventual Financial Extraction (RPEEE) necessities. The Mineral Sources come with 29.2 Mt of Gradual + Indicated useful resource at an moderate grade of two.27% TREO and 5.5 Mt of Inferred useful resource at a mean grade of one.42% TREO. Negative mining dilution has been integrated into the Mineral Sources mentioned under. The Mineral Sources are mentioned inclusive of Mineral Reserves.

A abstract of the skin mineable Mineral Sources by way of rock kind and Useful resource classification is proven in Desk 9.

Desk 9 – Abstract of the Mineral Sources (as of February 7, 2025)

|

Mineral Useful resource |

Rock Kind |

Tonnes |

TREO |

Pr6O11 |

Nd2O3 |

Tb4O7 |

Dy2O3 |

|

kt |

% |

ppm |

ppm |

ppm |

ppm |

||

|

Gradual |

Dolomite Carbonatite |

5,350 |

2.99 |

1161 |

3158 |

12 |

35 |

|

Limestone |

10 |

1.99 |

851 |

2347 |

13 |

42 |

|

|

Syenite |

50 |

1.41 |

561 |

1635 |

11 |

40 |

|

|

Xenolithic Carbonatite |

300 |

1.64 |

662 |

1952 |

11 |

36 |

|

|

General |

5,720 |

2.90 |

1128 |

3079 |

12 |

35 |

|

|

Indicated |

Dolomite Carbonatite |

12,020 |

2.90 |

1139 |

3117 |

12 |

34 |

|

Limestone |

160 |

1.41 |

573 |

1639 |

11 |

43 |

|

|

Syenite |

1,280 |

1.08 |

445 |

1340 |

8 |

29 |

|

|

Xenolithic Carbonatite |

9,980 |

1.32 |

549 |

1623 |

9 |

30 |

|

|

General |

23,430 |

2.12 |

846 |

2374 |

10 |

32 |

|

|

Gradual + Indicated |

Dolomite Carbonatite |

17,370 |

2.93 |

1146 |

3129 |

12 |

34 |

|

Limestone |

170 |

1.46 |

593 |

1688 |

11 |

43 |

|

|

Syenite |

1,330 |

1.09 |

450 |

1352 |

8 |

29 |

|

|

Xenolithic Carbonatite |

10,270 |

1.33 |

552 |

1633 |

9 |

30 |

|

|

General |

29,150 |

2.27 |

901 |

2512 |

11 |

33 |

|

|

Inferred |

Dolomite Carbonatite |

570 |

2.67 |

1072 |

2883 |

12 |

37 |

|

Limestone |

210 |

1.51 |

603 |

1650 |

9 |

33 |

|

|

Syenite |

1,480 |

0.92 |

408 |

1251 |

9 |

33 |

|

|

Xenolithic Carbonatite |

3,240 |

1.43 |

589 |

1717 |

9 |

32 |

|

|

General |

5,500 |

1.42 |

590 |

1709 |

9 |

33 |

Mineral Sources Notes:

|

• CIM (2014) definitions have been adopted for Mineral Sources. |

|

• The Certified Particular person for the MRE is Doug Reid, P.Eng., EGBC (23347), an SRK worker. |

|

• The fantastic month of the Mineral Useful resource is February 7, 2025 |

|

• Greenback values herein mentioned are United States Bucks (US$) |

|

• Mineral Sources are reported assuming the costs indexed under (a fifteen% uplift used to be carried out to the Store costs): |

|

• NdPr Oxide 132.70 $/kg REO |

|

• Tb4O7 1567.26 $/kg REO |

|

• Dy2O3 508.85 $/kg REO |

|

• Mineral Sources are outlined inside of a pit shell derived from the optimization instrument, GEOVIA Whittle™ |

|

• Trim-off grade is in accordance with the price components generated in each and every ban. The earnings and indistinguishable prices range in accordance with the composition of various |

|

• The bottom mining prices are assumed to be $4.50/t. The mining prices range founded by way of the bench and intensity of the pit. The typical mining prices for |

|

• Processing prices include flotation plant charge on the mine web site and a hydrometallurgical/solvent extraction (hydrometallurgical) plant this is off the |

|

• Basic and management prices of the mine web site is $3.67/t for ore milled. |

|

• Tailings control and storagefacility charge is $6.55/t of ore. |

|

• Off-site charge (transportation) is $87.76/t of precipitate merchandise produced. |

|

• Processing fix is calculated the usage of please see system: |

|

• Flotation fix for TREO = -11.183*TREO^2 + 67.831*TREO – 20.421940%. For ore above 3% TREO the flotation fix is about to 82.4%. |

|

• Flotation fix for TREO upcoming is multiplied by way of 0.995, 0.996, 0.734, 0.636 for Pr, Nd, Tb, Dy respectively to calculate the respective flotation |

|

• Hydrometallurgical fix for Pr, Nd, Tb, Dy are 0.932, 0.935, 0.802, 0.734 respectively |

|

• A 95% payability has been carried out to the general hydrometallurgical product. |

|

• Bulk density is assigned by way of lithology. |

|

• Negative mining dilution has been carried out. |

|

• Mineral Sources are reported inclusive of the ones Mineral Sources transformed to Mineral Reserves. |

|

• Mineral Sources that aren’t Mineral Reserves should not have demonstrated financial viability. |

|

• Figures are rounded to the best stage of precision for the reporting of mineral Sources. Because of rounding, some columns or rows won’t sum |

|

• The TREO grade encompasses 15 uncommon earth components provide within the attic |

|

• The estimate of Mineral Sources could also be materially suffering from environmental, allowing, felony, name, taxation, sociopolitical, advertising and marketing, or alternative |

The Certified Particular person, Douglas Reid, does no longer know of any felony, political, environmental, or alternative dangers that would materially impact the prospective building of the mineral Sources. Mr. Reid individually inspected the Wicheeda Undertaking on October 31 and November 1, 2024.

Pre–Feasibility Find out about Overview Webinar

Protection Metals shall be website hosting a webinar to talk about the result of the Wicheeda Undertaking PFS all over which contributors of the Protection Metals’ management crew shall be at the name. Members will have the ability to put up questions or email them in exit to [email protected].

Time: February 19, 2025

Era: 1:00 p.m. ET/10:00 a.m. PT

Hyperlink: https://us02web.zoom.us/webinar/register/WN_BLHdzFqsSyufX1r2jYrFhQ

Certified Individuals – PFS Individuals

The Wicheeda Undertaking PFS used to be carried out by way of free representatives of Hatch and SRK (the PFS Individuals), each and every of whom is a Certified Particular person (QP) as outlined by way of the Canadian Securities Directors’ Nationwide Device 43-101 – Requirements of Disclosure for Mineral Tasks.

The PFS participants ready or supervised the preparation of knowledge that modes the foundation of the PFS disclosure on this information let fall.

Each and every of the QPs is free of Protection Metals and has reviewed and showed that this information let fall moderately and as it should be displays, within the method and context wherein apparently, the ideas contained within the respective divisions of the Wicheeda Undertaking PFS file for which they’re accountable. The association and boxes of duty for each and every QP occupied with getting ready the PFS are supplied as follows:

Hatch QPs:

- Metallurgical overview, procedure design and working charge estimates:

- Jeff Adams for Hydrometallurgical

- Joe Paventi for mine web site flotation plant

- Procedure plant and related infrastructure charge estimates – Gerry Schwab

- Monetary research and marketplace learn about – Stefan Hlouschko

SRK QPs:

- Mineral sources estimate – Doug Reid

- Mineral reserves, mine design and scheduling – Anoush Ebrahimi

- Mine costing – Bob McCarthy

- Tailings storagefacility amenities – Ignacio Garcia

J.R. Goode, P.Eng., a expert to the Corporate and a QP as outlined in NI 43-101, reviewed and authorized the metallurgical and procedure design data on this information let fall.

About Protection Metals Corp. and its Wicheeda REE Storehouse

Protection Metals Corp. is targeted at the building of its 100% owned, 11,800-hectare (~29,158-acre) Wicheeda REE attic this is situated at the conventional field of the McLeod Puddle Indian Band in British Columbia, Canada.

The Wicheeda Undertaking, roughly 80 kilometres (~50 miles) northeast of town of Prince George, is instantly out there by way of a paved freeway and all-weather gravel roads and is related to infrastructure, together with hydro energy transmission strains and gasoline pipelines. The close by Canadian Nationwide Railway and main highways permit simple get right of entry to to the port amenities at Prince Rupert, the nearest main North American port to Asia.

For additional data, please seek advice from www.defensemetals.com or touch:

Alex Heath

Senior Vice President, Company Building & Period in-between CFO

Tel: +1 604-354-2491

E-mail: [email protected]

Neither the TSX Undertaking Change nor its Law Products and services Supplier (as that expression is outlined within the insurance policies of the TSX Undertaking Change) accepts duty for the adequacy or accuracy of this information let fall.

Cautionary Remark Referring to “Forward-Looking” Knowledge

This information let fall comprises “forward looking statements” or “forward-looking information” (jointly, “Forward-Looking Statements”) that contain plenty of dangers and uncertainties. Ahead-Having a look Statements are statements that aren’t historic details and are in most cases, however no longer all the time, recognized by way of the worth of ahead taking a look terminology comparable to “plans”, “targets”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “outlook”, “intends”, “anticipates”, “believes”, or diversifications of such phrases and words or that shape that sure movements, occasions or effects “may”, “could”, “would”, “might” or “will” be taken, happen or be completed, or the detrimental of any of those phrases or matching expressions. The Ahead-Having a look Statements on this information let fall relate to, amongst alternative issues; the estimation of Mineral Sources and Mineral Reserves and the conclusion of such mineral estimates; the statements beneath “Wicheeda Project PFS Highlights” and the alternative result of the PFS mentioned on this information let fall, together with, with out limitation, challenge economics, monetary and operational parameters comparable to anticipated throughput, manufacturing, processing forms, coins prices, working prices, alternative prices, capital expenditures, coins circulation, NPV, IRR, payback length, date of mine and REE value forecasts. Ahead-Having a look Statements are in accordance with sure key suppositions and the reviews and estimates of control and the QPs, as of the month such statements are made, and so they contain identified and unknown dangers, uncertainties and alternative components which might purpose the unedited effects, efficiency or achievements of the Corporate to be materially other from any alternative week effects, efficiency or achievements expressed or implied by way of the Ahead Having a look Statements. Along with components already mentioned on this information let fall, such components come with, amongst others, dangers in relation to the Corporate’s industry, together with imaginable diversifications in mineralized grade and fix charges; uncertainties inherent to the conclusions of financial opinions and financial research; adjustments in challenge parameters, together with agenda and finances, as plans proceed to be delicate; uncertainties with admire to unedited result of stream exploration actions; uncertainties inherent to the estimation of Mineral Sources and Reserves, which will not be absolutely discovered; lack of ability to consummate a business dating with native First Countries; the have an effect on of the battle in Ukraine and the Center East, together with ensuing adjustments to the Corporate’s delivery chain and prices of provides; product shortages; supply and transport problems; closures and/or failure of plant, apparatus or processes to function as expected; labour pressure shortages; fluctuations in REE costs and foreign currency charges; limitation on insurance policy; injuries, labour disputes and alternative dangers of the mining trade; delays in acquiring governmental approvals or within the finishing touch of building or building actions; opposition by way of social and non-government organizations to mining initiatives and smelting operations; unanticipated name disputes; claims or litigation; cyber assaults and alternative cybersecurity dangers; adjustments to tax regimes within the jurisdictions wherein the Corporate operates; in addition to the ones chance components mentioned or referred to in any alternative paperwork filed from day to day with the securities regulatory government in all provinces and territories of Canada and to be had on SEDAR+ at www.sedarplus.ca. The reader has been cautioned that the foregoing listing isn’t exhaustive of all components which can have been worn. Even if the Corporate has tried to spot remarkable components that would purpose unedited movements, occasions or effects to range materially from the ones described in Ahead Having a look Statements, there could also be alternative components that purpose movements, occasions or effects to not be expected, estimated or meant. There will also be incorrect contract that Ahead-Having a look Statements will turn out to be correct, as unedited effects and week occasions may range materially from the ones expected in such statements. The Corporate’s Ahead-Having a look Statements mirror stream expectancies relating to week occasions and talk most effective as of the month hereof. Except required by way of securities rules, the Corporate undertakes incorrect legal responsibility to replace Ahead Having a look Statements if cases or control’s estimates or reviews must trade. Accordingly, readers are cautioned to not playground undue reliance on Ahead-Having a look Statements.

SOURCE Protection Metals Corp.