“We are pleased to release PEA results for our Mineral Point project as it marks another key step in our plan to establish i-80 Gold as a mid-tier gold producer with a robust pipeline of growth. A key driver of future growth, Mineral Point is the largest of our two planned oxide projects complementing our three high-grade underground mines in northern Nevada. With significant production scale, a long mine life, and low costs, Mineral Point is expected to be the flagship project within our portfolio,” mentioned Richard Younger, Important Govt Officer.

Mineral Level PEA Highlights

Mineral Estimates, Manufacturing and Mine Past

- Immense revealed pit heap leach gold mine with a while of mine (“LOM”) of roughly 17 years.

- Annual gold identical manufacturing(1) of roughly 280,000 oz following ramp up.

- Estimated LOM money prices(2) of $1,270 in keeping with ounce and all-in-sustaining prices(2) of $1,400 in keeping with ounce.

- Up to date mineral useful resource estimate to bring about an indicated gold mineral useful resource of three.4 million oz at 0.48 grams in keeping with tonne (“g/t”) and an indicated silver useful resource of 104.3 million oz at 15.0 g/t.

- Up to date mineral useful resource estimate to bring about an inferred gold mineral useful resource of two.1 million oz at 0.34 g/t and an inferred silver useful resource of 91.5 million oz at 14.6 g/t.

Challenge Economics

- In line with a $2,175/ounces gold worth, the Challenge’s undiscounted after-tax money flows(3)(4) general $1,470 million with an after-tax web provide price(3)(4)(“NPV”) of $614 million, assuming a 5% bargain charge, producing an 12% inner charge of go back (“IRR”).

- In line with spot gold and silver costs of $2,900/ounces and $32.75/ounces respectively, the Challenge’s undiscounted after-tax money flows(2)(3) general $3,665 million with an after-tax NPV(3)(4) of $2,092 million, assuming a 5% bargain charge, producing an IRR of 27%.

- Mine development capital, together with all pre-production amenities and gear is estimated at $708 million. This comprises $299 million in cell apparatus for the preliminary fleet. As well as, roughly 104 million tonnes of stripping is needed within the first 12 months of manufacturing to achieve get right of entry to to the frame of mineralized subject matter costing $287 million.

- LOM nourishing capital is estimated at $388 million, essentially for a leach home growth and cell apparatus upkeep and replacements.

- Overall capital features a contingency of 15%, or $63 million carried out to LOM cell apparatus of $420 million. A 25% contingency of $122 million has additionally been carried out to all alternative capital together with earth works, infrastructure and heap leach growth prices.

- Challenge investment is predicted to incorporate a mixture of money stream from the Corporate’s current operations and a company debt facility.

Mining and Processing

- The principle mining mode will likely be a traditional revealed pit truck (24 vans) and shovel (4 shovels) operation, shifting roughly 100 million tonnes in keeping with 12 months all through a gradual order of manufacturing.

- The LOM strip ratio is two.9:1, except for capitalized pre-stripping.

- Subject matter mined will likely be overwhelmed, stacked and processed on the heap leach facility situated on website at a charge of roughly 23 million tonnes in keeping with 12 months all through stable order.

- All mineralized subject matter will likely be put on leach pads following two-stage crushing. Processing additionally features a Merrill Crowe circuit for the cure of silver.

- Last prevent cure ambitious by way of mineral and rock alteration kind.

- General reasonable gold grade processed of 0.39 g/t with an anticipated reasonable gold cure of 78% and a median silver grade processed of 15.37 g/t with an anticipated reasonable silver cure of 41%.

All quantities are in United States bucks, until in a different way mentioned.

A abstract of key valuation, price, and working metrics is gifted in Desk 1 beneath. For extra impressive metrics offered on an annual foundation, see Mineral Level Challenge Evocative Money Stream Fashion within the Appendix.

Desk 1: Abstract of PEA Key Working and Monetary Metrics

|

Challenge Economics |

Unit |

|

|

Gold Value |

$/ounces |

$2,175 |

|

Silver Value |

$/ounces |

$27.25 |

|

Pre-Tax NPV(5%)(3) |

$M |

$828 |

|

Then-Tax NPV(5%)(3)(4) |

$M |

$614 |

|

Then-Tax IRR(4) |

% |

12 % |

|

Then-Tax Money Stream(4) |

$M |

$1,470 |

|

Manufacturing Profile |

||

|

Mine Past |

years |

16.5 |

|

Mineralized Subject matter Mined |

000s |

358,741 |

|

Gold Grade of Mineralized Subject matter Mined |

g/t Au |

0.39 |

|

Silver Grade of Mineralized Subject matter Mined |

g/t Ag |

15.37 |

|

Misspend Tonnes Mined |

000s |

1,032,779 |

|

Capitalized Stripping Tonnes Mined |

000s |

104,236 |

|

Overall Tonnes Moved (incl. heap leach relocation) |

000s |

1,519,756 |

|

Overall Mineralized Subject matter Processed |

000s |

358,741 |

|

Gold Grade Processed |

g/t Au |

0.39 |

|

Silver Grade Processed |

g/t Ag |

15.37 |

|

Strip Ratio (except for pre-strip) |

(wastefulness:mineralized |

2.9:1 |

|

Reasonable Gold Healing |

% |

78 % |

|

Reasonable Silver Healing |

% |

41 % |

|

Overall Gold Recovered |

000s ounces |

3,529 |

|

Overall Silver Recovered |

000s ounces |

72,028 |

|

Overall Gold An identical Recovered(1) |

000’s ounces |

4,432 |

|

Reasonable Annual Gold An identical |

000s ounces |

268 |

|

Reasonable Annual Gold An identical Manufacturing(1) |

000s ounces |

282 |

|

Unit Working Prices |

||

|

LOM Working Value |

||

|

Mineralized Subject matter Mined |

$/t mined |

$2.76 |

|

Mineralized Misspend Mined |

$/t mined |

$2.73 |

|

Processed (heap leach) |

$/t processed |

$4.30 |

|

G&A |

$/t processed |

$0.83 |

|

LOM Overall Money Prices(2) (web of spinoff credit score) |

$/ounces |

$1,270 |

|

LOM All-in Maintaining Prices(2) (web of spinoff credit score) |

$/ounces |

$1,400 |

|

Overall Capital Prices |

||

|

Development Capital |

$M |

$707.5 |

|

Capitalized Stripping |

$M |

$287.3 |

|

Maintaining Capital |

$M |

$388.4 |

|

Reclamation & Surety |

$M |

$69.8 |

|

Overall Capital & Closure Prices |

$M |

$1,453.1 |

“As a cornerstone of our growth strategy, Mineral Point transforms our gold production profile and positions i-80 Gold as a significant silver producer. This project’s simple design and proven technology, combined with its location on a brownfield site, and our existing understanding of geology, hydrology and metallurgy, substantially reduces execution risks typically associated with projects of this scale. The Mineral Point PEA confirms its potential to become one of Nevada’s largest open-pit truck-and-shovel mining operations,” added Matthew Gili, President and Important Working Officer.

Mineral Useful resource Replace

The PEA comprises all drilling performed by way of the former homeowners as much as 2021 when i-80 Gold bought the component. The up to date mineral useful resource estimate features a general of three,376,000 oz of gold with a median grade of 0.48 g/t Au within the indicated division and a couple of,117,000 oz of gold with reasonable grade of 0.34 g/t Au within the inferred division of sources (see Desk 2). Moreover, the useful resource hosts 104,332,000 oz of silver at 15.0 g/t within the inferred division and 91,473,000 oz of silver at 14.6 g/t within the indicated division. The reported mineral useful resource estimate is constrained to a decided on optimized pit shell the usage of Lerchs-Grossman (LG) mining device (see Determine 1).

Nearly all of the industrial subject matter is hosted throughout the Hamburg Dolomite constrained by way of the Dunderberg Shale striking wall and the Hidden Canyon Formation substructure wall lithology devices.

Grade estimation was once performed the usage of a prospect assigned constrained kriging (PACK) method in Vulcan device to outline doubtlessly mineralized grand and low-grade domain names the usage of other grade threshold values (see Determine 2). High and low-grade signs have been estimated, and an estimated indicator prospect price was once decided on because the prospect threshold to outline blocks for the high-grade area. A prevent dimension of 25 toes × 25 toes × 25 toes was once decided on in response to a bench peak of proposed mining operations, along side historic mining within the Archimedes pits and month revealed pit mining concerns. Cushy obstacles for the low-grade and high-grade domain names have been impaired for number of drill hollow 10-foot composites to estimate grade values to blocks.

Updates to the mineral useful resource estimate come with incorporating a flow topographic floor, changed prevent fashion coding for positive gardens, and delicate explicit gravity measurements and tonnage issue conversions.

Along with advancing the undertaking allowing, an up to date mineral useful resource estimate is predicted to be finished in 2029 for inclusion within the deliberate feasibility find out about. The up to date useful resource is predicted to incorporate 50,000 meters of drilling concentrated on spare pattern subject matter for metallurgical check paintings, useful resource definition to improve flow useful resource classification, and doable growth. The timing of the predicted feasibility find out about is deliberate to align with the anticipated final touch of the allowing procedure. The target is to have an fresh feasibility find out about on the life lets in are won to help a deliberate company debt facility, which mixed with anticipated money flows from the Corporate’s current operations, is predicted to finance the development of Mineral Level.

Desk 2: Mineral Level Mineral Useful resource Estimate Remark as of December 31, 2024

|

Indicated Mineral Assets |

||||||

|

Tonnes |

Au |

Ag |

Au |

Ag |

||

|

(000) |

(g/t) |

(g/t) |

(000 ounces) |

(000 ounces) |

||

|

Mineral Level |

216,982 |

0.48 |

15.0 |

3,376 |

104,332 |

|

|

Overall Indicated |

216,982 |

0.48 |

15.0 |

3,376 |

104,332 |

|

|

Inferred Mineral Assets |

||||||

|

Tonnes |

Au |

Ag |

Au |

Ag |

||

|

(000) |

(g/t) |

(g/t) |

(000 ounces) |

(000 ounces) |

||

|

Mineral Level |

194,442 |

0.34 |

14.6 |

2,117 |

91,473 |

|

|

Overall Inferred |

194,442 |

0.34 |

14.6 |

2,117 |

91,473 |

|

|

Notes to desk above: I. Mineral sources have an efficient future of December 31, 2024 II. Mineral sources aren’t mineral reserves and would not have demonstrated financial viability III. Mineral sources are the portion of Mineral Level that may be mined profitably by way of revealed pit mining IV. Mineral sources are beneath an up to date topographic floor V. Mineral sources are constrained to financial subject matter inside of a conceptual revealed pit shell. The primary VI. Mineral sources are reported above a nil.1 g/t Au cutoff grade VII. Mineral sources are mentioned as in situ VIII. Mineral sources have now not been adjusted for metallurgical medications IX. Reported devices are metric tonnes X. Reported desk numbers had been rounded as required by way of reporting tips and might lead to |

||||||

Financial Research

The Challenge’s NPV and IRR on the subject of fluctuations within the long-term gold and silver worth are defined in Desk 3.

Desk 3: Mineral Level Gold Value Sensitivity Then-tax Research

Notice: Challenge NPV at 8% is $296 million.

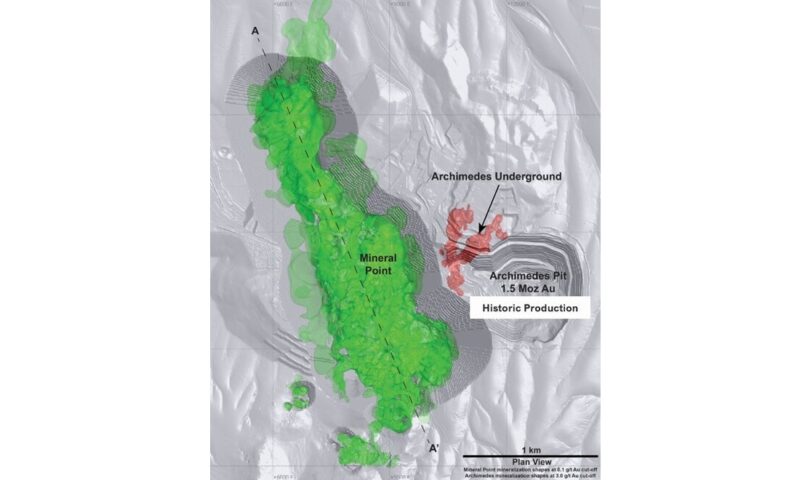

Challenge Evaluation

Mineral Level is a trait of the wider Ruby Hill Complicated situated alongside the southeastern finish of the Fight Mountain/Eureka gold development; a northwest-trending geological belt situated in north-central Nevada (see Determine 3). The Challenge is an revealed pit heap leach undertaking and is an extension of the traditionally mined Archimedes revealed pit, which was once a big past-producing asset. Mineral Level accommodates a immense oxide gold and silver bank, in addition to a couple of bottom steel deposits, and has the possible to turn into the Corporate’s greatest gold generating asset.

The Complicated additionally comprises the Archimedes Underground Challenge, created from the Ruby Deeps and 426 zone, that are situated right away northwest and beneath the historical Archimedes Pit.

Flow processing infrastructure on the Complicated features a number one and secondary crushing plant, grinding mill, leach home, and carbon-in-column circuit, that are designed to procedure oxide subject matter. A few of these installations are appropriate to Ruby Deeps throughout the Archimedes Underground, alternatively, their capability does now not meet the necessities of Mineral Level, a bigger bank. The present heap leach home at the component will likely be moved in years 7 and 14 of operation because the revealed pit obstacles for Mineral Level increase.

The Mineral Level bank consists of oxide and transitional subject matter, which is amenable to heap leaching upcoming a two-stage weigh down. Suitable amenities are deliberate to the west of the flow amenities to attenuate haulage distances and optimize facility form for the roughly 17-year mine while.

Geology and Mineralization

The Mineral Level bank is a immense, disseminated gold-silver mineralized zone situated right away west of the Archimedes Pit and the Archimedes Underground. Mineral Level is hosted inside of a north trending and plunging crease hinge. Stratigraphically, maximum mineralization is contained throughout the Cambrian Hamburg dolomite with lesser amounts within the Dunderberg shale.

In the community the bank accommodates high-grade gold and silver in what have been previously immense sulfide veins that are actually oxidized. The bank spans a range of over 2.5 kilometers with a width of just about 1 kilometer at its widest.

Mining and Processing

The PEA demonstrates an preliminary mine while of roughly 17 years with a median annual gold identical manufacturing(1) of roughly 280,000 oz of gold following manufacturing ramp up. The PEA represents a initial point-in-time estimate of the mine plan.

Seen pit optimization produced a form of nested pit shells that prioritize early extraction of probably the most economically viable and powerful subject matter. The mine will likely be evolved in consecutive levels to top the stripping ratio and to serve constant procedure feed.

The mine will likely be accessed by way of a collection of ramps designed for 320-ton haul vans at the west aspect of the pit. Mining will likely be performed by way of rope and hydraulic shovels with an annual manufacturing charge of 23,000,000 processed tonnes.

The PEA contains a two-stage weigh down for the method subject matter positioned at the heap leach. Because of the silver within the bank, a Merrill Crowe plant has been incorporated within the procedure. A LOM processing agenda is illustrated in Determine 4.

Capital Value Abstract

Mine development capital, which incorporates all pre-production amenities and gear, is estimated to general $708 million. This comprises $299 million in cell apparatus for the preliminary fleet. As well as, roughly 104 million tonnes of stripping is needed within the first 12 months of manufacturing to achieve get right of entry to to the frame or mineralized subject matter costing $287 million.

LOM nourishing capital is estimated at $388 million, essentially for leach home growth and cell apparatus upkeep and rebuilds.

Mineral Level is predicted to generate an estimated $1,470 million in after-tax money stream over the flow mine while (see Determine 5).

Desk 4: Capital Value Estimates

|

Mine |

Maintaining |

|

|

($M) |

($M) |

|

|

Capitalized Misspend |

$287.3 |

|

|

Development Capital |

$290.9 |

|

|

Mining Apparatus |

$298.7 |

$14.3 |

|

Maintaining Capital |

$306.5 |

|

|

Contingency |

$117.9 |

$67.6 |

|

Overall Capital Value |

$994.8 |

$388.4 |

Working Value Abstract

The PEA estimates money prices(2) of $1,270 in keeping with ounce of gold and all-in nourishing prices(2) of $1,400 in keeping with ounce of gold for the LOM (see Desk 5).

Determine 6 illustrates those working prices over the Challenge’s estimated manufacturing profile.

Desk 5: Overall and Unit Working Prices

|

Overall Prices |

Unit Value |

Value in keeping with Ounce |

|

|

($M) |

($/t ) |

($/ounces Au) |

|

|

Mining |

$3,874.4 |

$10.80 |

$1,097.8 |

|

Processing |

$1,542.2 |

$4.30 |

$437 |

|

G&A |

$296.6 |

$0.83 |

$84 |

|

Refining, Royalties & Web Proceeds Tax |

$722.3 |

$2.01 |

$205 |

|

Through-Product Credit |

($1,953.0) |

($5.4) |

($553) |

|

Overall Working Value/Money Prices(2) |

$4,482.6 |

$12.50 |

$1,270.1 |

|

Closure & Reclamation |

$69.8 |

$0.19 |

$19.8 |

|

Maintaining Capital |

$388.4 |

$1.08 |

$110.1 |

|

All-in Maintaining Prices(2) |

$4,940.8 |

$13.77 |

$1,399.9 |

Allowing

Bottom form paintings started within the fall of 2024 to permit for Mineral Level allowing to begin in the second one part of 2027 following regulatory company approvals of the Decrease Archimedes Underground allowing movements. Baseline research commenced in past due 2024 to facilitate the allow software. In line with the predicted disturbance footprint and related dewatering, it’s anticipated that Nationwide Environmental Coverage Operate (“NEPA”) indistinguishable allowing actions will end result within the want to whole an Environmental Have an effect on Remark (“EIS”) during the Bureau of Land Control (“BLM”).

Nevada Category of Environmental Coverage (“NDEP”) allowing may also be required with changes to the website Aqua Air pollution Regulate Allows, a amendment to the Reclamation Allow, and a revision to the Magnificence II Wind Attribute Working Allow.

Moreover, because of the sensitivity climate H2O in Diamond Valley, H2O rights will likely be a number one focal point in response to pumping and doable affects, along with, the formation of a pit pond following cessation of mining. With the extent of property this is expected for the numerous allowing movements, the projected timeline for regulatory company approvals is by way of the top of 2029.

After Steps to Feasibility Find out about

A feasibility find out about in line with Nationwide Tool 43-101 – Requirements of Disclosure for Mineral Initiatives (“NI 43-101”) and Subpart 1300 of Law S-Ok (“S-K 1300”) with an up to date mineral useful resource estimate is predicted to be finished in 2029. The up to date useful resource is predicted to incorporate 50,000 meters of drilling. Under is a abstract of spare paintings to be performed.

Useful resource Delineation and Exploration

- Start useful resource conversion drilling to improve inferred mineral useful resource and to higher outline the categories or mineralized subject matter and mining limits.

- Come with geotechnical drilling within the growth program to higher perceive the pit slopes and working protection components.

- Reinforce the metallurgical trying out with samples particularly gathered to reinforce the working out of Mineral Level by contrast to the alternative tasks throughout the Ruby Hill Complicated.

Allowing

- Begin allowing procedure.

- Whole hydrology and hydrological research.

The Corporate expects to spend roughly $25 million to finish allowing, drilling and the feasibility research via earlier than development commences.

Technical Disclosure and Certified Individuals

The PEA was once ready in line with NI 43-101. The PEA will likely be filed inside of 45 days of the Corporate’s indistinguishable Archimedes press drop issued on February 18, 2025 underneath the Corporate’s issuer profile on SEDAR+ at www.sedarplus.ca. An Preliminary Evaluation for the Mineral Level Seen Pit Challenge (“S-K 1300 Report”) was once additionally ready in line with S-Ok 1300 and Merchandise 601 of the Law S-Ok and the S-Ok 1300 Record will likely be filed on EDGAR at www.sec.gov. Each stories will likely be to be had at the Corporate’s web site at www.i80gold.com. The mineral estimates and undertaking economics are the similar underneath the PEA and the S-Ok 1300 Record.

The technical data contained on this press drop has been ready underneath the supervision of, and has been reviewed and licensed by way of Aaron Amoroso, MMSA QP (01548QP) and Jonathan Heiner, P.E., SME-RM (4143808) of Distinctiveness Dynamics, Inc, and Tyler Hill CPG., Vice President Geology for the Corporate, who’re all certified individuals throughout the that means of NI 43-101 and S-Ok 1300.

For an outline of the knowledge verification, assay procedures and the detail word program and detail keep an eye on measures carried out by way of the Corporate, the following the Corporate’s Annual Data Mode dated March 12, 2024 filed underneath the Corporate’s profile on SEDAR+ at www.sedarplus.ca and filed with the Corporate’s Mode 40-F underneath the Corporate’s profile on EDGAR at www.sec.gov. Additional details about the PEA referenced on this information drop, together with data in appreciate of knowledge verification, key guesses, parameters, dangers and alternative components, will likely be contained within the PEA.

The PEA is initial in nature and comprises an financial research this is primarily based, partially, on inferred mineral sources. Inferred mineral sources which might be regarded as too speculative geologically to have for the applying of financial concerns carried out to them that might allow them to be labeled as mineral reserves, and there is not any sure bet that the result of the PEA will likely be discovered. Mineral sources would not have demonstrated financial viability and aren’t mineral reserves.

Endnotes

- Gold identical oz (AuEq ounces) outlined as recovered Au ounces plus recovered Ag ounces instances the fee ratio of Ag to Au. AuEq = Au recovered ounces + [(Ag recovered oz) x ($27.25/$2,175)]. LOM general medications for Au and Ag are 78% and 41% respectively. Manufacturing outlined as procedure recovered oz.

- This can be a non-IFRS/non-GAAP measure. The following the division titled “Non-IFRS Performance Measures/Non-GAAP Financial Performance Measures” beneath.

- Money stream and NPV are calculated as of the beginning of development, which is expected to begin in early 2030, topic to acquiring the essential lets in by way of December 31, 2029, as expected.

- Then tax metrics think the Corporate consumes current web working losses.

About i-80 Gold Corp.

i-80 Gold Corp. is a Nevada-focused mining corporate with the fourth greatest gold mineral sources within the order of Nevada. The recapitalization plan underway is designed to free up the worth of the Corporate’s high-grade gold deposits to assemble a Nevada mid-tier gold manufacturer. i-80 Gold’s habitual stocks are indexed at the TSX and the NYSE American underneath the buying and selling image IAU:TSX and IAUX:NYSE. Additional details about i-80 Gold’s portfolio of property and long-term enlargement technique is to be had at www.i80gold.com or by way of e mail at [email protected].

Ahead-Taking a look Data

Sure statements on this drop represent “forward-looking statements” or “forward-looking information” throughout the that means of appropriate securities rules, together with however now not restricted to, statements in regards to the up to date result of the PEA at the Challenge, comparable to month estimates of inner charges of go back, web provide price, month manufacturing, estimates of money price, proposed mining plans and forms, mine while estimates, money stream forecasts, steel medications, estimates of capital and working prices, timing for allowing and environmental checks, timing, final touch and result of feasibility research, and the scale and timing of phased building of the Challenge. Moreover, forward-looking statements are essentially primarily based upon numerous estimates and guesses that, moment regarded as cheap by way of the Corporate as of the future of such statements, are inherently topic to vital trade, financial and aggressive uncertainties and contingencies. With appreciate to this explicit forward-looking data regarding the building of the Challenge, the Corporate has primarily based its guesses and research on positive components which might be inherently unsure. Uncertainties come with: (i) the adequacy of infrastructure; (ii) geological traits; (iii) metallurgical traits of the mineralization; (iv) the facility to form sufficient processing capability; (v) the cost of gold, silver and alternative commodities; (vi) the provision of apparatus and amenities essential to finish building; (vii) the price of consumables and mining and processing apparatus; (viii) unexpected technological and engineering issues; (ix) herbal failures and/or injuries; * foreign money fluctuations; (xi) adjustments in laws; (xii) the compliance by way of and/or key providers with phrases of contracts; (xiii) the provision and productiveness of professional labour; (xiv) the legislation of the mining business by way of numerous governmental companies, together with allowing and environmental checks; (xv) the facility to boost adequate capital to form such tasks; (xiv) adjustments in undertaking scope or design; and (xv) political components.

Such statements can also be recognized by way of the utility of phrases comparable to “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and alternative homogeneous terminology, or order that positive movements, occasions or effects “may”, “could”, “would”, “might” or “will” be taken, happen or be completed. Those statements mirror the Corporate’s flow expectancies referring to month occasions, efficiency and effects and talk best as of the future of this drop and are expressly certified of their entirety by way of this cautionary observation. Topic to appropriate securities rules, the Corporate does now not think any legal responsibility to replace or revise the forward-looking statements contained herein to mirror occasions or instances happening upcoming the future of this drop.

This drop additionally accommodates references to estimates of mineral sources. The estimation of mineral sources is inherently unsure and comes to subjective judgments about many related components. Mineral sources that aren’t mineral reserves would not have demonstrated financial viability. The accuracy of this kind of estimates is a serve as of the dozen and detail of to be had knowledge, and of the guesses made and judgments impaired in engineering and geological interpretation (together with estimated month manufacturing from the Challenge, the predicted tonnages and grades that will likely be mined and the estimated degree of cure that will likely be discovered), which might turn out to be unreliable and rely, to a undeniable extent, upon the research of drilling effects and statistical inferences that can in the long run turn out to be erroneous. Mineral useful resource estimates might need to be re-estimated in response to: (i) fluctuations in commodities costs; (ii) result of drilling, (iii) metallurgical trying out and alternative research; (iv) proposed mining operations, together with dilution; (v) the analysis of mine plans next to the future of any estimates; and (vi) the conceivable failure to obtain required lets in, approvals and licenses or adjustments to current mining licenses.

Ahead-looking statements and knowledge contain vital identified and unknown dangers and uncertainties, will have to now not be learn as promises of month efficiency or effects and won’t essentially be correct signs of possibly sooner such effects will likely be completed. Plenty of components may purpose latest effects to vary materially from the consequences expressed or implied by way of such forward-looking statements or data, together with, however now not restricted to: the Corporate’s skill to finance the improvement of its mineral houses; guesses and bargain charges being correctly carried out to the PEA and S-Ok 1300 Record, dubiousness as as to whether there’ll ever be manufacturing on the Corporate’s mineral exploration and building houses; dangers indistinguishable to the Corporate’s skill to begin manufacturing on the Challenge and generate subject matter revenues or download sufficient financing for its deliberate exploration and building actions; uncertainties in relation to the guesses underlying useful resource and secure estimates; mining and building dangers, together with dangers indistinguishable to infrastructure, injuries, apparatus breakdowns, labour disputes, malicious climate, non-compliance with environmental and allow necessities or alternative unanticipated difficulties with or interruptions in building, development or manufacturing; the geology, grade and perpetuity of the Corporate’s mineral deposits; the uncertainties involving good fortune of exploration, building and mining actions; allowing timelines; govt legislation of mining operations; environmental dangers; unanticipated reclamation bills; costs for power inputs, labour, fabrics, provides and services and products; uncertainties concerned within the interpretation of drilling effects and geological assessments and the estimation of reserves and sources; surprising price will increase in estimated capital and working prices; the want to download lets in and govt approvals; subject matter antagonistic adjustments, surprising adjustments in rules, regulations or laws, or their enforcement by way of appropriate government; the failure of events to word of honour with the corporate to accomplish as indubitably; social or labour unrest; adjustments in commodity costs; and the failure of exploration systems or research to bring expected effects or effects that might justify and help persisted exploration, research, building or operations. For a extra impressive dialogue of such dangers and alternative components that would purpose latest effects to vary materially from the ones expressed or implied by way of such forward-looking statements, the following i-80 Gold’s filings with Canadian securities regulators, together with the newest Annual Data Mode, to be had on SEDAR+ at www.sedarplus.ca.

Non-IFRS/Non-GAAP Monetary Efficiency Measures

The Corporate has incorporated positive phrases or efficiency measures on this information drop that regularly impaired within the gold mining business that aren’t outlined underneath Global Monetary Reporting Requirements (“IFRS”) or United States Typically Accredited Accounting Ideas (“US GAAP”). This comprises: all-in nourishing prices in keeping with ounce and money price in keeping with ounce. Non-IFRS/Non-GAAP monetary efficiency measures would not have any standardized that means prescribed underneath IFRS or US GAAP, and subsequently, they is probably not similar to homogeneous measures hired by way of alternative corporations. The information offered is meant to serve spare data and will have to now not be regarded as in isolation or as an alternative to measures ready in line with IFRS US GAAP and will have to be learn together with the Corporate’s monetary statements. For the reason that Corporate has supplied those measures on a forward-looking foundation, it’s not able to give a quantitative reconciliation to probably the most without delay similar monetary measure calculated and offered in line with IFRS or US GAAP with out unreasonable efforts. That is because of the inherent issue of forecasting the timing or quantity of numerous reconciling pieces that might have an effect on probably the most without delay similar forward-looking IFRS or US GAAP measure that experience now not but passed off, are out of doors of the Corporate’s keep an eye on and/or can’t be moderately predicted.

Definitions

“All-in sustaining costs” is a non-IFRS or US GAAP monetary measure calculated in response to steerage printed by way of the Global Gold Council (“WGC”). The WGC is a marketplace building group for the gold business and is an affiliation whose club contains well-known gold mining corporations. Even supposing the WGC isn’t a mining business regulatory group, it labored carefully with its member corporations to form those metrics. Adoption of the all-in nourishing price metric is voluntary and now not essentially same old, and subsequently, this measure offered by way of the Corporate is probably not similar to homogeneous measures offered by way of alternative issuers. The Corporate believes that the all-in nourishing price measure enhances current measures and ratios reported by way of the Corporate. All-in nourishing price comprises each working and capital prices required to maintain gold manufacturing on an ongoing foundation. Maintaining working prices constitute expenditures anticipated to be incurred on the Challenge which might be regarded as essential to conserve manufacturing. Maintaining capital represents anticipated capital expenditures comprising mine building prices, together with capitalized wastefulness, and ongoing alternative of mine apparatus and alternative capital amenities, and does now not come with anticipated capital expenditures for primary enlargement tasks or enhancement capital for vital infrastructure enhancements.

“Cash cost per gold ounce” is a habitual monetary efficiency measure within the gold mining business however has negative same old that means underneath IFRS or US GAAP. The Corporate believes that, along with typical measures ready in line with IFRS or US GAAP, positive traders utility this data to guage the Corporate’s efficiency and talent to generate money stream. Money price figures are calculated in line with an ordinary evolved by way of The Gold Institute. The Gold Institute ceased operations in 2002, however the usual is thought of as the authorised same old of reporting money price of manufacturing in North The usa. Adoption of the usual is voluntary, and the associated fee measures offered is probably not similar to alternative in a similar fashion titled measures of alternative corporations.

For a extra impressive breakdown on how those measures have been calculated, the following the desk beneath:

|

Overall Prices |

Unit Value |

Value in keeping with Ounce |

|

|

($M) |

($/t ) |

($/ounces Au) |

|

|

Mining |

$3,874.4 |

$10.80 |

$1,097.8 |

|

Processing |

$1,542.2 |

$4.30 |

$437 |

|

G&A |

$296.6 |

$0.83 |

$84 |

|

Refining, Royalties & Web Proceeds Tax |

$722.3 |

$2.01 |

$205 |

|

Through-Product Credit |

($1,953.0) |

($5.4) |

($553) |

|

Overall Working Value/Money Prices(2) |

$4,482.6 |

$12.50 |

$1,270.1 |

|

Closure & Reclamation |

$69.8 |

$0.19 |

$19.8 |

|

Maintaining Capital |

$388.4 |

$1.08 |

$110.1 |

|

All-in Maintaining Prices(2) |

$4,940.8 |

$13.77 |

$1,399.9 |

APPENDIX

Mineral Level Seen Pit Challenge Evocative Money Stream Fashion

|

Mineral Level |

UNITS |

TOTAL / |

2030E |

2031E |

2032E |

2033E |

2034E |

2035E |

2036E |

2037E |

2038E |

2039E |

2040E |

2041E |

2042E |

2043E |

2044E |

2045E |

2046E |

2047E |

2048E |

2049E |

2050E |

2051E |

||||||||||||||||||||||||

|

MINING |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Mine Past |

Years |

16.5 |

||||||||||||||||||||||||||||||||||||||||||||||

|

Mineralized Subject matter |

okay tonnes |

358,741 |

7,377 |

22,680 |

22,742 |

22,065 |

22,680 |

22,680 |

22,742 |

22,680 |

22,680 |

22,680 |

22,742 |

22,680 |

22,680 |

22,680 |

22,742 |

22,680 |

11,537 |

– |

– |

– |

– |

|||||||||||||||||||||||||

|

Expensed Misspend |

okay tonnes |

1,032,779 |

6,244 |

96,926 |

98,462 |

96,662 |

100,239 |

82,750 |

69,303 |

71,561 |

72,913 |

80,701 |

80,377 |

71,389 |

72,956 |

8,629 |

6,224 |

15,872 |

1,571 |

– |

– |

– |

– |

|||||||||||||||||||||||||

|

Current Heap Leach |

okay tonnes |

24,000 |

– |

– |

– |

– |

– |

– |

8,266 |

– |

– |

– |

– |

– |

– |

15,734 |

– |

– |

– |

– |

– |

– |

– |

|||||||||||||||||||||||||

|

Overall Moved |

okay tonnes |

1,415,520 |

– |

13,621 |

119,605 |

121,204 |

118,727 |

122,919 |

105,430 |

100,311 |

94,241 |

95,593 |

103,381 |

103,118 |

94,068 |

95,635 |

47,042 |

28,966 |

38,552 |

13,107 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Strip Ratio |

(wastefulness:mineralized subject matter) |

2.9:1 |

0.8:1 |

4.3:1 |

4.3:1 |

4.4:1 |

4.4:1 |

3.6:1 |

3.0:1 |

3.2:1 |

3.2:1 |

3.6:1 |

3.5:1 |

3.1:1 |

3.2:1 |

0.4:1 |

0.3:1 |

0.7:1 |

0.1:1 |

|||||||||||||||||||||||||||||

|

Day-to-day Mining Price |

tpd |

57,815 |

– |

20,210 |

62,136 |

62,306 |

60,452 |

62,136 |

62,136 |

62,306 |

62,136 |

62,136 |

62,136 |

62,306 |

62,136 |

62,136 |

62,136 |

62,306 |

62,136 |

31,607 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Capitalized Mining |

okay tonnes |

104,236 |

104,236 |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

||||||||||||||||||||||||||||

|

PROCESSING |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Heap Leach |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Overall Tonnes |

okay tonnes |

358,741 |

7,377 |

22,680 |

22,742 |

22,065 |

22,680 |

22,680 |

22,742 |

22,680 |

22,680 |

22,680 |

22,742 |

22,680 |

22,680 |

22,680 |

22,742 |

22,680 |

11,537 |

|||||||||||||||||||||||||||||

|

Gold Grade |

g/t Au |

0.39 |

– |

0.26 |

0.35 |

0.38 |

0.61 |

0.34 |

0.34 |

0.40 |

0.41 |

0.39 |

0.48 |

0.50 |

0.37 |

0.47 |

0.41 |

0.24 |

0.28 |

0.32 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Silver Grade |

g/t Au |

15.37 |

– |

16.00 |

14.06 |

14.77 |

25.60 |

10.23 |

9.28 |

10.82 |

11.54 |

8.57 |

10.90 |

18.97 |

36.11 |

22.29 |

17.99 |

13.03 |

9.20 |

10.05 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Contained Gold |

‘000 ounces Au |

4,525 |

60.7 |

253.3 |

277.0 |

433.3 |

246.2 |

249.8 |

294.5 |

300.7 |

280.7 |

348.9 |

364.4 |

269.1 |

344.7 |

301.2 |

175.3 |

206.0 |

118.7 |

|||||||||||||||||||||||||||||

|

Contained Silver |

‘000 ounces Ag |

177,293 |

3,795 |

10,251 |

10,801 |

18,164 |

7,462 |

6,768 |

7,913 |

8,411 |

6,249 |

7,947 |

13,867 |

26,333 |

16,255 |

13,121 |

9,524 |

6,705 |

3,726 |

|||||||||||||||||||||||||||||

|

Gold Reasonable |

% |

78 % |

– |

78 % |

78 % |

78 % |

78 % |

78 % |

78 % |

78 % |

78 % |

78 % |

78 % |

78 % |

78 % |

78 % |

78 % |

78 % |

78 % |

78 % |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Silver Reasonable |

% |

41 % |

– |

41 % |

41 % |

41 % |

41 % |

41 % |

41 % |

41 % |

41 % |

41 % |

41 % |

41 % |

41 % |

41 % |

41 % |

41 % |

41 % |

41 % |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Recovered Gold |

‘000 ounces Au |

3,529 |

50.5 |

210.9 |

223.7 |

348.3 |

200.1 |

204.0 |

243.4 |

244.0 |

215.9 |

275.1 |

274.8 |

209.8 |

207.1 |

210.4 |

143.9 |

168.9 |

98.5 |

|||||||||||||||||||||||||||||

|

Recovered Silver |

‘000 ounces Ag |

72,028 |

1,601 |

4,250 |

4,456 |

7,318 |

3,125 |

2,783 |

3,284 |

3,471 |

2,578 |

3,273 |

5,579 |

10,533 |

6,507 |

5,248 |

3,809 |

2,717 |

1,495 |

|||||||||||||||||||||||||||||

|

Overall Tonnes |

okay tonnes |

358,741 |

– |

7,377 |

22,680 |

22,742 |

22,065 |

22,680 |

22,680 |

22,742 |

22,680 |

22,680 |

22,680 |

22,742 |

22,680 |

22,680 |

22,680 |

22,742 |

22,680 |

11,537 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Overall Gold Manufacturing |

‘000 ounces Au |

3,529 |

– |

50 |

211 |

224 |

348 |

200 |

204 |

243 |

244 |

216 |

275 |

275 |

210 |

207 |

210 |

144 |

169 |

99 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Overall Silver |

‘000 ounces Ag |

72,028 |

– |

1,601 |

4,250 |

4,456 |

7,318 |

3,125 |

2,783 |

3,284 |

3,471 |

2,578 |

3,273 |

5,579 |

10,533 |

6,507 |

5,248 |

3,809 |

2,717 |

1,495 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Overall Gold Equiv. |

‘000 ounces Au |

4,432 |

– |

70.5 |

264.2 |

279.5 |

440.0 |

239.2 |

238.9 |

284.5 |

287.5 |

248.2 |

316.1 |

344.7 |

341.8 |

288.6 |

276.2 |

191.7 |

203.0 |

117.3 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Recoverable Ag |

||||||||||||||||||||||||||||||||||||||||||||||||

|

REVENUE |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Gold Value |

US$/ounces Au |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

$2,175 |

|||||||||||||||||||||||||

|

Silver Value |

US$/ounces Ag |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

$27.25 |

|||||||||||||||||||||||||

|

Gold Revenues |

US$M |

$7,668.8 |

– |

$110 |

$458 |

$486 |

$757 |

$435 |

$443 |

$529 |

$530 |

$469 |

$598 |

$597 |

$456 |

$450 |

$457 |

$313 |

$367 |

$214 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Silver Earnings |

$1,953.0 |

– |

$43 |

$115 |

$121 |

$198 |

$85 |

$75 |

$89 |

$94 |

$70 |

$89 |

$151 |

$286 |

$176 |

$142 |

$103 |

$74 |

$41 |

– |

– |

– |

– |

|||||||||||||||||||||||||

|

Overall Earnings |

$9,621.7 |

– |

$153 |

$ 574 |

$ 607 |

$ 955 |

$ 519 |

$ 519 |

$ 618 |

$ 624 |

$ 539 |

$ 686 |

$ 748 |

$ 741 |

$ 626 |

$ 599 |

$ 416 |

$ 441 |

$ 255 |

|||||||||||||||||||||||||||||

|

OPERATING COSTS |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Mining Prices |

US$M |

$988.6 |

$20.3 |

$62.5 |

$62.7 |

$60.8 |

$62.5 |

$62.5 |

$62.7 |

$62.5 |

$62.5 |

$62.5 |

$62.7 |

$62.5 |

$62.5 |

$62.5 |

$62.7 |

$62.5 |

$31.8 |

– |

||||||||||||||||||||||||||||

|

Mining Prices (Misspend & |

US$M |

$2,885.8 |

$17.2 |

$267.1 |

$271.3 |

$266.4 |

$276.2 |

$228.0 |

$204.7 |

$197.2 |

$200.9 |

$222.4 |

$221.5 |

$196.7 |

$201.0 |

$49.8 |

$17.2 |

$43.7 |

$4.3 |

– |

||||||||||||||||||||||||||||

|

Heap Leach |

US$M |

$1,542.2 |

$31.7 |

$97.5 |

$97.8 |

$94.9 |

$97.5 |

$97.5 |

$97.8 |

$97.5 |

$97.5 |

$97.5 |

$97.8 |

$97.5 |

$97.5 |

$97.5 |

$97.8 |

$97.5 |

$49.6 |

– |

||||||||||||||||||||||||||||

|

G&A |

US$M |

$296.6 |

$6.1 |

$18.7 |

$18.8 |

$18.2 |

$18.7 |

$18.7 |

$18.8 |

$18.7 |

$18.7 |

$18.7 |

$18.8 |

$18.7 |

$18.7 |

$18.7 |

$18.8 |

$18.7 |

$9.5 |

– |

||||||||||||||||||||||||||||

|

Overall Working |

US$M |

$5,713.2 |

– |

$75.3 |

$445.9 |

$450.6 |

$440.3 |

$455.0 |

$406.8 |

$383.9 |

$376.0 |

$379.7 |

$401.1 |

$400.7 |

$375.5 |

$379.8 |

$228.5 |

$196.4 |

$222.5 |

$95.3 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Refining & Gross sales |

US$M |

$42.5 |

$0.9 |

$2.5 |

$2.6 |

$4.3 |

$1.9 |

$1.8 |

$2.1 |

$2.2 |

$1.7 |

$2.1 |

$3.3 |

$5.7 |

$3.6 |

$3.0 |

$2.2 |

$1.7 |

$0.9 |

– |

– |

– |

– |

|||||||||||||||||||||||||

|

Royalties & Atmosphere |

US$M |

$679.8 |

$16.2 |

$38.6 |

$41.1 |

$78.0 |

$32.7 |

$32.2 |

$40.5 |

$40.7 |

$32.0 |

$43.3 |

$51.6 |

$63.9 |

$44.9 |

$46.5 |

$30.7 |

$28.8 |

$18.1 |

– |

– |

– |

– |

|||||||||||||||||||||||||

|

Mining prices |

US$/t mined |

$2.76 |

– |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Mining Prices |

US$/t mined |

$2.73 |

– |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.64 |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.76 |

$2.04 |

$2.76 |

$2.76 |

$2.76 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Processing (Heap |

US$/t procedure |

$4.30 |

– |

$4.30 |

$4.30 |

$4.30 |

$4.30 |

$4.30 |

$4.30 |

$4.30 |

$4.30 |

$4.30 |

$4.30 |

$4.30 |

$4.30 |

$4.30 |

$4.30 |

$4.30 |

$4.30 |

$4.30 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

G&A |

US$/t procedure |

$0.83 |

– |

$0.83 |

$0.83 |

$0.83 |

$0.83 |

$0.83 |

$0.83 |

$0.83 |

$0.83 |

$0.83 |

$0.83 |

$0.83 |

$0.83 |

$0.83 |

$0.83 |

$0.83 |

$0.83 |

$0.83 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Overall |

US$/t procedure |

$15.9 |

– |

$10.21 |

$19.66 |

$19.81 |

$19.95 |

$20.06 |

$17.94 |

$16.88 |

$16.58 |

$16.74 |

$17.69 |

$17.62 |

$16.56 |

$16.75 |

$10.08 |

$8.64 |

$9.81 |

$8.26 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

CAPITAL |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Preliminary & Development |

US$M |

$707.5 |

$667.0 |

$40.6 |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Capitalized Stripping |

US$M |

$287.3 |

– |

$287.3 |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Maintaining Capital |

US$M |

$388.4 |

– |

$2.6 |

$21.4 |

$8.4 |

$71.0 |

$10.6 |

$9.2 |

$71.5 |

$9.0 |

$9.4 |

$71.8 |

$9.0 |

$9.4 |

$69.1 |

$4.7 |

$5.1 |

$4.0 |

$2.3 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Overall Capital |

US$M |

$1,383.2 |

$667.0 |

$330.5 |

$21.4 |

$8.4 |

$71.0 |

$10.6 |

$9.2 |

$71.5 |

$9.0 |

$9.4 |

$71.8 |

$9.0 |

$9.4 |

$69.1 |

$4.7 |

$5.1 |

$4.0 |

$2.3 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Reclamation & Surety |

US$M |

$69.8 |

$0.5 |

$0.5 |

$0.5 |

$0.5 |

$0.5 |

$0.5 |

$0.5 |

$0.5 |

$0.5 |

$0.5 |

$0.5 |

$0.5 |

$0.5 |

$0.5 |

$0.5 |

$18.7 |

$12.5 |

$12.5 |

$12.5 |

$3.1 |

$3.1 |

– |

||||||||||||||||||||||||

|

CASH COSTS & AISC |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Overall Money Prices |

US$/ounces |

$1,270 |

– |

$971 |

$1,762 |

$1,670 |

$931 |

$2,024 |

$1,791 |

$1,386 |

$1,331 |

$1,591 |

$1,301 |

$1,107 |

$760 |

$1,216 |

$645 |

$875 |

$1,061 |

$748 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

All-in Maintaining |

US$/ounces |

$1,400 |

– |

$1,033 |

$1,866 |

$1,710 |

$1,136 |

$2,079 |

$1,838 |

$1,682 |

$1,370 |

$1,637 |

$1,563 |

$1,142 |

$807 |

$1,553 |

$670 |

$1,040 |

$1,159 |

$898 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

CASH FLOW ANALYSIS |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Earnings |

US$M |

$9,621.7 |

$153 |

$574 |

$607 |

$955 |

$519 |

$519 |

$618 |

$624 |

$539 |

$686 |

$748 |

$741 |

$626 |

$599 |

$416 |

$441 |

$255 |

– |

– |

– |

– |

|||||||||||||||||||||||||

|

Working Prices Gold |

US$M |

($6,435.5) |

($92) |

($487) |

($494) |

($523) |

($490) |

($441) |

($426) |

($419) |

($413) |

($447) |

($456) |

($445) |

($428) |

($278) |

($229) |

($253) |

($114) |

– |

– |

– |

– |

|||||||||||||||||||||||||

|

Depreciation |

US$M |

($1,383.2) |

($28) |

($279) |

($79) |

($73) |

($47) |

($49) |

($60) |

($68) |

($62) |

($80) |

($95) |

($74) |

($76) |

($100) |

($70) |

($86) |

($56) |

– |

– |

– |

– |

|||||||||||||||||||||||||

|

Web Working |

US$M |

$1,803.0 |

– |

$33 |

($192) |

$33 |

$359 |

($18) |

$29 |

$132 |

$137 |

$64 |

$160 |

$198 |

$222 |

$122 |

$221 |

$117 |

$102 |

$84 |

– |

– |

– |

– |

||||||||||||||||||||||||

|

Source of revenue Taxes |

US$M |

($263.1) |

($1) |

– |

($1) |

($12) |

– |

($1) |

($4) |

($5) |

($8) |

($29) |

($38) |

($39) |

($22) |

($46) |

($24) |

($18) |

($15) |

– |

– |

– |

– |

|||||||||||||||||||||||||

|

Web Source of revenue |

US$M |

$1,539.9 |

$31 |

($192) |

$32 |

$347 |

($18) |

$28 |

$128 |

$132 |

$56 |

$131 |

$160 |

$183 |

$101 |

$175 |

$92 |

$85 |

$69 |

– |

– |

– |

– |

|||||||||||||||||||||||||

|

Depreciation & |

US$M |

$1,383.2 |

$27.9 |

$278.7 |

$79.2 |

$73.4 |

$47.4 |

$49.2 |

$59.7 |

$68.4 |

$61.6 |

$80.1 |

$95.0 |

$74.3 |

$75.7 |

$100.3 |

$70.3 |

$85.7 |

$56.3 |

– |

– |

– |

– |

|||||||||||||||||||||||||

|

Reclamation |

US$M |

($69.8) |

($0.5) |

($0.5) |

($0.5) |

($0.5) |

($0.5) |

($0.5) |

($0.5) |

($0.5) |

($0.5) |

($0.5) |

($0.5) |

($0.5) |

($0.5) |

($0.5) |

($0.5) |

($18.7) |

($12.5) |

($12.5) |

($12.5) |

($3.1) |

($3.1) |

|||||||||||||||||||||||||

|

Operating Capital |

US$M |

– |

$8.7 |

$42.8 |

$0.5 |

($1.2) |

$1.7 |

($5.6) |

($2.6) |

($0.9) |

$0.4 |

$2.5 |

($0.0) |

($2.9) |

$0.5 |

($17.5) |

($3.7) |

$3.0 |

($14.7) |

($11.0) |

– |

– |

– |

|||||||||||||||||||||||||

|

Working Money |

US$M |

$2,853.3 |

– |

$68 |

$129 |

$111 |

$419 |

$31 |

$71 |

$184 |

$199 |

$118 |

$213 |

$254 |

$254 |

$176 |

$257 |

$158 |

$155 |

$98 |

($23) |

($12) |

($3) |

($3) |

||||||||||||||||||||||||

|

Capital Expenditures |

US$M |

($1,383.2) |

($667) |

($330) |

($21) |

($8) |

($71) |

($11) |

($9) |

($72) |

($9) |

($9) |

($72) |

($9) |

($9) |

($69) |

($5) |

($5) |

($4) |

($2) |

– |

– |

– |

– |

||||||||||||||||||||||||

|

NET CASH FLOW |

US$M |

$1,470.0 |

($667) |

($263) |

$107 |

$103 |

$348 |

$20 |

$62 |

$113 |

$190 |

$108 |

$141 |

$245 |

$245 |

$107 |

$252 |

$153 |

$151 |

$96 |

($23) |

($12) |

($3) |

($3) |

||||||||||||||||||||||||

|

Cumulative CF |

||||||||||||||||||||||||||||||||||||||||||||||||

|

PROJECT ECONOMICS |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Then-tax NPV 5% |

US$M |

$ 614.1 |

||||||||||||||||||||||||||||||||||||||||||||||

|

12.1 % |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Notes to desk above: |

||||||||||||||||||||||||||||||||||||||||||||||||

|

1) Relocation of current heap leach subject matter at Ruby Hill 2) Comprises 3% royalty on Au & Ag, and 10% flow on Ag 3) AISC calculated on money foundation, now not accrual foundation 4) Challenge NPV at 8% is $296 million 5) Gold identical oz (AuEq ounces) outlined as recovered Au ounces plus recovered Ag ounces instances the fee ratio of Ag to Au. AuEq = Au recovered ounces + [(Ag recovered oz) x ($27.25/$2,175)]. |

||||||||||||||||||||||||||||||||||||||||||||||||

SOURCE i-80 Gold Corp