Company Delivers 7th Consecutive Quarter of Expanding Revenues and Profits

Management Reviews Financial Results and Provides Business Update on Quarterly Webcast

CHARLOTTE, N.C., Aug. 28, 2024 /PRNewswire/ — TAT Technologies Ltd. (NASDAQ: TATT) (TASE: TATT) (“TAT” or the “Company”), a leading provider of products and services to the commercial and military aerospace and ground defense industries, reported today its unaudited results for the three-month and six-month period ended June 30, 2024.

Financial Highlights for the Second Quarter and First Six Months of 2024:

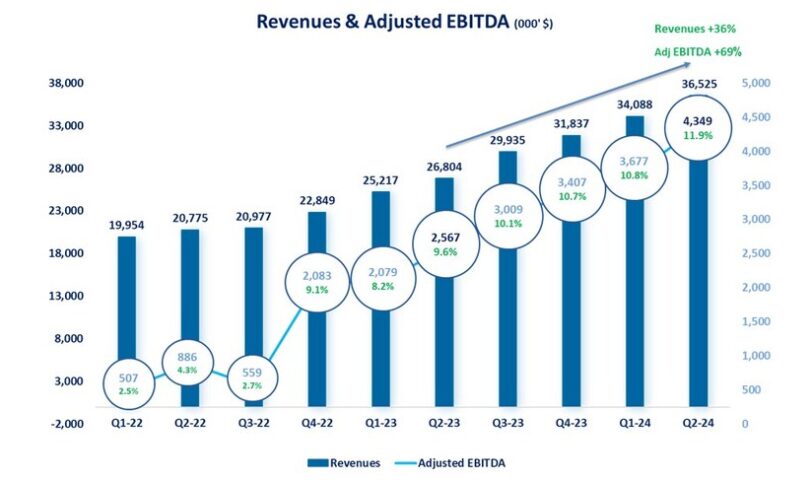

- Revenues increased by 36.2% to $36.5 million compared to $26.8 million for the second quarter of 2024. For the first half of 2024 revenues increased by 36% to 70.6$ million compared to $52 million in the first half of 2023.

- Gross profit increased by 47.1% to $8.0 million compared to $5.4 million for the second quarter of 2023 (21.9% of revenues in Q2\24 compared to 20.2% of revenues in Q2\23). For the first half of 2024 gross profit increase by 55.4% to $15.1 million compared to $9.7 million in the first half of 2023 (20.9% of revenues in H1\24 compared to 18.6% of revenues in H1\23)

- Operating Income increased by 78.5% to $2.7 million compared to $1.5 million in Q2\23, (7.5% of revenues in Q2\24 compared to 6.5% of revenues in Q2\23). For the first half of 2024 operating income increased by 99% to $4.9 million compared to $2.5 million in the first half of 2023 (7% of revenues in H1\24 compared to 4.8% of revenues in H1\23).

- Net Income increased by 78% to $2.6 million compared to $1.5 million in the second quarter of 2023. For the first half of 2024 net income increased by 122% to $4.7 million compared to $2.1 million in the first half of 2023.

- Adjusted EBITDA increased by 69.4% to $4.3 million (11.9% of revenues) compared to $2.6 million (9.6% of revenues) in the second quarter of 2023. Adjusted EBITDA for the first half of 2024 increased by 73% to $8 million compared $4.6 in the first half of 2023 (11.4% of revenues in H1\24 compared to 9% in H1\23).

- Cash flow from operating activities was negative $(4.1) million compared to positive cash flow of $2.5 million in the second half of 2023. Cash flow from operating activities for the first half of 2024 was negative $(7.7) million compared to positive cash flow of $4.2 million in the first half of 2023.

Mr. Igal Zamir, TAT’s CEO and President commented: “We are very proud to report another record quarter marked by revenue growth, margin expansion, and profitability improvement. Our results demonstrate increasing demand for our products and services, which are aligned with our growth strategy. This was the seventh consecutive quarter of growth in revenue and EBITDA, and given our growing momentum and backlog, we expect this trend to continue.”

“During the second quarter, we secured orders of more than $40 million, resulting in a record backlog and LTA Value of over $414 million,” continued Mr. Zamir. “These new orders give us significant visibility into revenue potential over the coming quarters and bolster our confidence in continued success. On top of the continued revenue growth, we invest efforts in improving our operational efficiency and cost structure. This resulted in an improved Gross margin and EBITDA margin.”

“During the first six months of 2024 we started serving APU of the newly certified 131 and 331-500 which serves a fleet of close to 20,000 aircraft (with a total addressable annual market of about $2 billion),” added Mr. Zamir. “The revenue obtained during the first half of 2024 is mainly driven from TAT’s historical products and services. The revenue from these new engines’ capabilities is insignificant. We are very excited about our future revenue growth and profits, as we start leveraging the potential of this new market. We will continue to expand our customer base for those engines MRO services according to our growth strategy”

Shareholder Webcast

Igal Zamir and Ehud Ben-Yeir, TAT’s CEO and CFO, have posted a webcast reviewing the financial results and to provide a business update. Investors interested in accessing the webcast can visit the investor relations section of the Company’s website at https://tat-technologies.com/investors/. The webcast will remain accessible on the website for at least 90 days.

Non-GAAP Financial Measures

To supplement the consolidated financial statements presented in accordance with GAAP, the Company also presents Adjusted EBITDA. The adjustments to the Company’s GAAP results are made with the intent of providing both management and investors a more complete understanding of the Company’s underlying operational results, trends and performance. Adjusted EBITDA is calculated as net income excluding the impact of: the Company’s share in results of affiliated companies, share-based compensation, taxes on income, financial (expenses) income, net, and depreciation and amortization. Adjusted EBITDA, however, should not be considered as alternative to net income and operating income for the period and may not be indicative of the historic operating results of the Company; nor it is meant to be predictive of potential future results. Adjusted EBITDA is not measure of financial performance under generally accepted accounting principles and may not be comparable to other similarly titled measures for other companies. See reconciliation of Adjusted EBITDA below.

About TAT Technologies LTD

TAT Technologies Ltd. is a leading provider of services and products to the commercial and military aerospace and ground defense industries. TAT operates under four segments: (i) Original equipment manufacturing (“OEM”) of heat transfer solutions and aviation accessories through its Gedera facility; (ii) MRO services for heat transfer components and OEM of heat transfer solutions through its Limco subsidiary; (iii) MRO services for aviation components through its Piedmont subsidiary; and (iv) Overhaul and coating of jet engine components through its Turbochrome subsidiary. TAT controlling shareholders is the FIMI Private Equity Fund.

TAT’s activities in the area of OEM of heat transfer solutions and aviation accessories primarily include the design, development and manufacture of (i) broad range of heat transfer solutions, such as pre-coolers heat exchangers and oil/fuel hydraulic heat exchangers, used in mechanical and electronic systems on board commercial, military and business aircraft; (ii) environmental control and power electronics cooling systems installed on board aircraft in and ground applications; and (iii) a variety of other mechanical aircraft accessories and systems such as pumps, valves, and turbine power units.

TAT’s activities in the area of MRO Services for heat transfer components and OEM of heat transfer solutions primarily include the MRO of heat transfer components and to a lesser extent, the manufacturing of certain heat transfer solutions. TAT’s Limco subsidiary operates an FAA-certified repair station, which provides heat transfer MRO services for airlines, air cargo carriers, maintenance service centers and the military.

TAT’s activities in the area of MRO services for aviation components include the MRO of APUs, landing gears and other aircraft components. TAT’s Piedmont subsidiary operates an FAA-certified repair station, which provides aircraft component MRO services for airlines, air cargo carriers, maintenance service centers and the military.

TAT’s activities in the area of overhaul and coating of jet engine components includes the overhaul and coating of jet engine components, including turbine vanes and blades, fan blades, variable inlet guide vanes and afterburner flaps.

For more information of TAT Technologies Ltd., please visit our web-site:

www.tat-technologies.com

Contact:

Mr. Eran Yunger

Director of IR

[email protected]

Safe Harbor for Forward-Looking Statements

This press release contains forward-looking statements which include, without limitation, statements regarding possible or assumed future operation results. These statements are hereby identified as “forward-looking statements” for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve risks and uncertainties that could cause our results to differ materially from management’s current expectations. Actual results and performance can also be influenced by other risks that we face in running our operations including, but are not limited to, general business conditions in the airline industry, changes in demand for our services and products, the timing and amount or cancellation of orders, [LTAs] and backlog, the price and continuity of supply of component parts used in our operations, and other risks detailed from time to time in the Company’s filings with the Securities Exchange Commission, including, its annual report on form 20-F and its periodic reports on form 6-K. These documents contain and identify other important factors that could cause actual results to differ materially from those contained in our projections or forward-looking statements. Shareholders and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We undertake no obligation to update publicly or revise any forward-looking statement.

|

TAT TECHNOLOGIES AND ITS SUBSIDIARIES |

||||

|

CONDENSED CONSOLIDATED BALANCE SHEET |

||||

|

(In thousands) |

||||

|

Jun 30, |

December 31, |

|||

|

2024 |

2023 |

|||

|

(unaudited) |

(audited) |

|||

|

ASSETS |

||||

|

CURRENT ASSETS: |

||||

|

Cash and cash equivalents |

$ 8,058 |

$ 15,979 |

||

|

Accounts receivable, net of allowance for credit losses of $305 and $345 thousand as of Jun 30, 2024 and December 31, 2023 |

26,197

|

20,009

|

||

|

Restricted deposit |

– |

661 |

||

|

Other current assets and prepaid expenses |

6,722 |

6,397 |

||

|

Inventory |

56,763 |

51,280 |

||

|

Total current assets |

97,740 |

94,326 |

||

|

NON-CURRENT ASSETS: |

||||

|

Restricted deposit |

294 |

302 |

||

|

Investment in affiliates |

2,763 |

2,168 |

||

|

Funds in respect of employee rights upon retirement |

644 |

664 |

||

|

Deferred income taxes |

1,097 |

994 |

||

|

Property, plant and equipment, net |

40,934 |

42,554 |

||

|

Operating lease right of use assets |

2,656 |

2,746 |

||

|

Intangible assets, net |

1,687 |

1,823 |

||

|

Total non-current assets |

50,075 |

51,251 |

||

|

Total assets |

$ 147,815 |

$ 145,577 |

||

|

LIABILITIES AND EQUITY |

||||

|

CURRENT LIABILITIES: |

||||

|

Current maturities of long-term loans |

$ 1,937 |

$ 2,200 |

||

|

Short term loans |

12,547 |

12,138 |

||

|

Accounts payable |

9,079 |

9,988 |

||

|

Accrued expenses |

12,907 |

13,952 |

||

|

Operating lease liabilities |

1,155 |

1,033 |

||

|

Total current liabilities |

37,625 |

39,311 |

||

|

NON CURRENT LIABILITIES: |

||||

|

Long-term loans |

11,970 |

12,886 |

||

|

Liability in respect of employee rights upon retirement |

998 |

1,000 |

||

|

Operating lease liabilities |

1,486 |

1,697 |

||

|

Total non-current liabilities |

14,454 |

15,583 |

||

|

Total liabilities |

$ 52,079 |

$ 54,894 |

||

|

EQUITY: |

||||

|

Share capital |

3,152 |

3,140 |

||

|

Translation reserves |

164 |

– |

||

|

Additional paid-in capital |

76,512 |

76,335 |

||

|

Treasury shares at cost |

(2,088) |

(2,088) |

||

|

Accumulated other comprehensive income |

27 |

|||

|

Retained earnings |

17,996 |

13,269 |

||

|

Total shareholders’ equity |

95,736 |

90,683 |

||

|

Total liabilities and shareholders’ equity |

147,815 |

$ 145,577 |

||

|

TAT TECHNOLOGIES AND ITS SUBSIDIARIES |

|||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

|||||||||

|

(In thousands, except share and per share data) |

|||||||||

|

Three months ended |

Six months ended |

Year ended |

|||||||

|

June 30, |

December 31, |

||||||||

|

2024 |

2023 |

2024 |

2023 |

2023 |

|||||

|

(Unaudited) |

(Unaudited) |

(Unaudited) |

(Unaudited) |

(Audited) |

|||||

|

Revenues: |

|||||||||

|

Products |

$ 11,732 |

$ 8,167 |

$ 23,667 |

$ 15,458 |

$ 35,241 |

||||

|

Services |

24,793 |

18,637 |

46,946 |

36,564 |

78,553 |

||||

|

36,525 |

26,804 |

70,613 |

52,022 |

113,794 |

|||||

|

Cost of goods: |

|||||||||

|

Products |

7,673 |

5,548 |

16,659 |

11,822 |

30,517 |

||||

|

Services |

20,868 |

15,830 |

38,904 |

30,515 |

60,809 |

||||

|

28,541 |

21,378 |

55,563 |

42,337 |

91,326 |

|||||

|

Gross Profit |

7,984 |

5,426 |

15,050 |

9,685 |

22,468 |

||||

|

Operating expenses: |

|||||||||

|

Research and development, net |

343 |

157 |

620 |

256 |

715 |

||||

|

Selling and marketing |

1,993 |

1,298 |

3,653 |

2,457 |

5,523 |

||||

|

General and administrative |

2,916 |

2,474 |

6,225 |

4,933 |

10,588 |

||||

|

Other income |

(2) |

(35) |

(390) |

(441) |

(433) |

||||

|

5,250 |

3,894 |

10,108 |

7,205 |

16,393 |

|||||

|

Operating income (Loss) |

2,734 |

1,532 |

4,942 |

2,480 |

6,075 |

||||

|

Interest expenses |

(413) |

(440) |

(763) |

(806) |

(1,683) |

||||

|

Other financial income (expenses), Net |

106 |

167 |

7 |

148 |

353 |

||||

|

Income before taxes on income (tax benefit) |

2,427 |

1,259 |

4,186 |

1,822 |

4,745 |

||||

|

Taxes on income (tax benefit) |

44 |

(63) |

(109) |

(90) |

576 |

||||

|

Income before share of equity investment |

2,383 |

1,322 |

4,295 |

1,912 |

4,169 |

||||

|

Profit of equity investment of affiliated |

234 |

153 |

432 |

221 |

503 |

||||

|

Net Income |

$ 2,617 |

$ 1,475 |

$ 4,727 |

$ 2,133 |

$ 4,672 |

||||

|

TAT TECHNOLOGIES AND ITS SUBSIDIARIES |

|||||||||

|

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME |

|||||||||

|

(In thousands) |

|||||||||

|

Basic and diluted income per share |

|||||||||

|

Net income per share |

$ 0.26 |

$ 0.16 |

$ 0.46 |

$ 0.24 |

$ 0.52 |

||||

|

Net income per diluted shares |

$ 0.25 |

$ 0.15 |

$ 0.44 |

$ 0.23 |

$ 0.51 |

||||

|

Weighted average number of shares |

|||||||||

|

Basic |

10,394,654 |

8,942,423 |

10,386,859 |

8,942,423 |

8,961,689 |

||||

|

Diluted |

10,561,420 |

9,052,163 |

10,722,153 |

9,052,163 |

9,084,022 |

||||

|

Three months ended |

Six months ended |

Year ended |

|||||||||||||

|

June 30, |

December 31, |

||||||||||||||

|

2024 |

2023 |

2024 |

2023 |

2023 |

|||||||||||

|

(Unaudited) |

(Unaudited) |

(Unaudited) |

(Unaudited) |

(Audited) |

|||||||||||

|

Net income |

$ 2,617 |

$ 1,475 |

$ 4,727 |

$ 2,133 |

$ 4,672 |

||||||||||

|

Other comprehensive income , net |

|||||||||||||||

|

Change in foreign currency translation |

164 |

– |

164 |

– |

– |

||||||||||

|

Net unrealized income from derivatives |

– |

26 |

(27) |

26 |

53 |

||||||||||

|

Total comprehensive income |

2,781 |

$ 1,501 |

$ 4,864 |

$ 2,159 |

$ 4,725 |

||||||||||

|

TAT TECHNOLOGIES AND ITS SUBSIDIARIES |

|||||||||||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY |

|||||||||||||||||

|

(In thousands, except share data) |

|||||||||||||||||

|

Share capital |

Accumulated |

||||||||||||||||

|

Number of |

Amount |

Additional |

Translation |

other |

Treasury |

Retained |

Total equity |

||||||||||

|

BALANCE AT DECEMBER 31, 2022 |

9,186,019 |

$ 2,842 |

$ 66,245 |

– |

$ (26) |

$ (2,088) |

$ 8,597 |

$ 75,570 |

|||||||||

|

CHANGES DURING THE YEAR ENDED |

|||||||||||||||||

|

Comprehensive loss |

– |

– |

– |

53 |

– |

4,672 |

4,725 |

||||||||||

|

Exercise of option |

32,466 |

8 |

157 |

– |

– |

– |

165 |

||||||||||

|

Issuance of common shares net of issuance costs of $141 |

1,158,600 |

290 |

9,774 |

– |

– |

– |

10,064 |

||||||||||

|

Share based compensation |

– |

– |

159 |

– |

– |

– |

159 |

||||||||||

|

BALANCE AT DECEMBER 31, 2023 |

10,377,085 |

$ 3,140 |

$ 76,335 |

– |

$ 27 |

$ (2,088) |

$ 13,269 |

$ 90,683 |

|||||||||

|

CHANGES DURING THE PERIOD ENDED JUN |

|||||||||||||||||

|

Comprehensive profit |

164 |

(27) |

– |

4,727 |

4,864 |

||||||||||||

|

Exercise of option |

49,109 |

12 |

(12) |

– |

– |

||||||||||||

|

Change in foreign currency translation adjustments |

– |

||||||||||||||||

|

Share based compensation |

189 |

189 |

|||||||||||||||

|

BALANCE AT JUN 30, 2024 (unaudited) |

10,426,194 |

3,152 |

76,512 |

164 |

– |

(2,088) |

17,996 |

95,736 |

|||||||||

|

TAT TECHNOLOGIES AND ITS SUBSIDIARIES |

||||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||||||

|

(In thousands) |

||||||||||

|

Three months ended |

Six months ended |

Year ended |

||||||||

|

June 30, |

December 31, |

|||||||||

|

2024 |

2023 |

2024 |

2023 |

2023 |

||||||

|

(Unaudited) |

(Unaudited) |

(Unaudited) |

(Unaudited) |

(Audited) |

||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

||||||||||

|

Net income |

$ 2,617 |

$ 1,475 |

$ 4,727 |

$ 2,133 |

$ 4,672 |

|||||

|

Adjustments to reconcile net income (loss) to net cash |

||||||||||

|

Depreciation and amortization |

1,431 |

901 |

2,805 |

1,942 |

4,710 |

|||||

|

Loss (gain) from change in fair value of derivatives |

– |

– |

22 |

– |

(9) |

|||||

|

Change in funds in respect of employee rights upon |

15 |

(27) |

20 |

(97) |

116 |

|||||

|

Change in operating right of use asset and operating leasing |

(3) |

– |

1 |

(6) |

22 |

|||||

|

Non-cash financial expenses |

(274) |

(134) |

(488) |

(248) |

(172) |

|||||

|

Decrease in restructuring plan provision |

(43) |

(32) |

(63) |

(90) |

(126) |

|||||

|

Change in allowance for credit losses |

40 |

(2) |

40 |

(5) |

(182) |

|||||

|

Share in results of affiliated companies |

(233) |

(153) |

(431) |

(221) |

(503) |

|||||

|

Share based compensation |

148 |

30 |

189 |

120 |

159 |

|||||

|

Liability in respect of employee rights upon retirement |

(5) |

(47) |

(2) |

(127) |

(148) |

|||||

|

Capital gain from sale of property, plant and equipment |

(1) |

(29) |

(355) |

(485) |

(530) |

|||||

|

Deferred income taxes, net |

306 |

(98) |

(103) |

(76) |

235 |

|||||

|

Changes in operating assets and liabilities: |

||||||||||

|

Decrease (increase) in trade accounts receivable |

(5,430) |

3,137 |

(6,250) |

1,123 |

(4,205) |

|||||

|

Decrease (increase) in other current assets and prepaid |

(144) |

359 |

(325) |

1,634 |

(341) |

|||||

|

Increase in inventory |

(2,906) |

(3,248) |

(5,543) |

(285) |

(5,400) |

|||||

|

Decrease in trade accounts payable |

(209) |

(1,034) |

(909) |

(2,155) |

(245) |

|||||

|

Increase (decrease) in accrued expenses and other |

591 |

1,352 |

(982) |

1,062 |

4,202 |

|||||

|

Net cash provided by (used in) operating activities from |

$ (4,100) |

$ 2,450 |

(7,647) |

$ 4,219 |

$ 2,255 |

|||||

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

||||||||||

|

Proceeds from sale of property and equipment |

– |

375 |

1,306 |

1,935 |

2,002 |

|||||

|

Purchase of property and equipment |

(978) |

(1,021) |

(1,967) |

(2,454) |

(5,102) |

|||||

|

Purchase of intangible assets |

– |

– |

– |

– |

(479) |

|||||

|

Cash flows used in investing activities |

$(978) |

$ (646) |

$ (661) |

$(519) |

$(3,579) |

|||||

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

||||||||||

|

Repayments of long-term loans |

(510) |

(425) |

(950) |

(847) |

(1,701) |

|||||

|

Short-term credit received from banks |

4,668 |

668 |

1,000 |

|||||||

|

Proceeds from long-term loans received |

– |

– |

712 |

|||||||

|

Issuance of common shares |

12 |

– |

12 |

– |

– |

|||||

|

Proceeds from issuance of common shares, net |

– |

– |

– |

– |

10,064 |

|||||

|

Exercise of options |

(13) |

165 |

(12) |

165 |

165 |

|||||

|

Cash flows provided by (used in) financing activities |

$ 4,157 |

$ (260) |

$ (282) |

$(682) |

$10,240 |

|||||

|

Net increase (decrease) in cash and cash equivalents and |

(921) |

1,546 |

(8,590) |

3,018 |

8,916 |

|||||

|

Cash and cash equivalents and restricted cash at |

9,273 |

9,498 |

16,942 |

8,026 |

8,026 |

|||||

|

Cash and cash equivalents and restricted cash at the end |

8,352 |

11,044 |

8,352 |

11,044 |

16,942 |

|||||

|

SUPPLEMENTARY INFORMATION ON INVESTING |

||||||||||

|

Additions of operating lease right-of-use assets and |

245 |

– |

590 |

– |

1,345 |

|||||

|

Reclassification of inventory to property, plant and |

– |

– |

60 |

– |

68 |

|||||

|

Supplemental disclosure of cash flow information: |

||||||||||

|

Interest paid |

(410) |

(267) |

(852) |

(512) |

(1,438) |

|||||

|

TAT TECHNOLOGIES AND ITS SUBSIDIARIES |

|||||||||

|

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA (NON-GAAP) |

|||||||||

|

(UNAUDITED) |

|||||||||

|

(In thousands) |

|||||||||

|

Three months ended |

Six months ended |

Year ended |

|||||||

|

June 30, |

June 30, |

December 31, |

|||||||

|

2024 |

2023 |

2024 |

2023 |

2023 |

|||||

|

Net income (Loss) |

$ 2,617 |

$ 1,475 |

$4,727 |

$ 2,133 |

$4,672 |

||||

|

Adjustments: |

|||||||||

|

Share in results and sale of equity |

(234) |

(153) |

(432) |

(221) |

(503) |

||||

|

Taxes on income (tax benefit) |

44 |

(63) |

(109) |

(90) |

576 |

||||

|

Financial expenses (income), net |

306 |

272 |

755 |

658 |

1,330 |

||||

|

Depreciation and amortization |

1,468 |

1,006 |

2,898 |

2,140 |

4,902 |

||||

|

Share based compensation |

148 |

30 |

189 |

120 |

159 |

||||

|

Adjusted EBITDA |

$ 4,349 |

$ 2,567 |

$ 8,028 |

$ 4,740 |

$ 11,136 |

||||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TAT TECHNOLOGIES LTD.

(Registrant)

By: /s/ Ehud Ben-Yair

Ehud Ben-Yair

Chief Financial Officer

Date: August 28, 2024

Photo – https://mma.prnewswire.com/media/2492171/EBITDA_Q224.jpg

Photo – https://mma.prnewswire.com/media/2492172/revenue_Q224.jpg

SOURCE TAT Technologies Ltd.