VANCOUVER, BC, Oct. 1, 2024 /PRNewswire/ – Unused Pacific Metals Corp. (TSX: NUAG) (NYSE-A: NEWP) (“New Pacific” or the “Company”) is happy to record the result of its Initial Financial Evaluate (“PEA”) for the Carangas mission (the “Project”) in Oruro Branch, Bolivia. The PEA is according to the Mineral Useful resource Estimate (the “MRE”) for the Mission, which used to be reported on September 5, 2023, and ready in line with Nationwide Tool 43‐101- Requirements of Disclosure for Mineral Tasks (“NI 43‐101”).

Highlights from the PEA are as follows (all figures in US Bucks):

- Put up-tax internet provide price (“NPV”) (5%) of $501 million and inside fee of go back (“IRR”) of 26% at a bottom case worth of $24.00/oz. silver, $1.25/lb zinc, and $0.95/lb manage;

- NPV and IRR of $748 million and 34%, respectively, at $30/oz. silver;

- 16-year pace of mine (“LOM”), aside from 2-years of pre-production, generating roughly 106 million oz. (“Moz”) of payable silver, 620 million kilos (“Mlbs”) of payable zinc and 382 Mlbs of payable manage;

- Payable silver manufacturing of roughly 8.5 Moz consistent with yr in years one thru six; with LOM moderate silver manufacturing exceeding 6.5 Moz consistent with yr;

- Preliminary capital prices of $324 million and a post-tax payback of three.2 years;

- Reasonable LOM all-in maintaining price (“AISC”) of $7.60/oz. silver, internet of by-products; and

- Roughly 500 direct everlasting jobs to be comprised of the Mission.

“The PEA for the Carangas project marks a significant milestone for our company, outlining a robust, high-margin project with strong economics. By focusing our efforts on a discrete, near surface, subset of silver rich material we were able to define a project with a post-tax NPV of $501 million, an IRR of 26% and an initial capital expenditure of $324 million,” said Andrew Williams, CEO and President.

“This study not only underscores the quality of this asset but also highlights the exceptional work of our team who discovered this greenfield project only three years ago. While Silver Sand remains our flagship asset, Carangas has become a significant standalone project for our Company. Carangas provides balance and scale to our portfolio of quality silver projects in Bolivia. We are grateful for the collaboration with the local community and government that has brought us to this point and look forward to continuing this partnership as we advance the Project and unlock value for all stakeholders.“

Financial Effects and Sensitivities

Desk 1 presentations key suppositions and summarizes the projected manufacturing and financial result of the PEA. Tables 2 and three display sensitivities to silver costs and working and capital prices.

Desk 1: Carangas Perceivable Pit Mining – Key Financial Suppositions and Effects

|

Merchandise |

Unit |

Worth |

|

Silver Worth |

$/oz. |

24 |

|

Zinc Worth |

$/lb |

1.25 |

|

Top Worth |

$/lb |

0.95 |

|

Overall Mill Feed |

Mt |

64.4 |

|

Perceivable Pit Strip Ratio1 |

t:t |

1.7 |

|

Annual Processing Fee |

Mtpa |

4.0 |

|

Reasonable Silver Grade2 |

g/t |

63 |

|

Reasonable Silver Grade in first 6 years |

g/t |

83 |

|

Silver Cure |

% |

87.3 |

|

Overall Payable Silver |

Moz |

106 |

|

Overall Payable Zinc |

Mlbs |

620 |

|

Overall Payable Top |

Mlbs |

382 |

|

Mine Month3 |

Yrs |

16.2 |

|

Reasonable Annual Payable Silver Steel over LOM |

Moz |

6.6 |

|

Annual Payable Silver Steel in first 6 years |

Moz |

8.5 |

|

Overall Earnings |

$M |

3,296 |

|

Overall Earnings Contribution from Silver |

% |

76 |

|

Overall Working Prices (internet of by-products)4 |

$/oz. |

4.25 |

|

Govt Royalties |

$/oz. |

1.79 |

|

AISC (internet of by-products)5 |

$/oz. |

7.60 |

|

Preliminary Capital Prices |

$M |

324 |

|

Maintaining Capital Prices6 |

$M |

128 |

|

Payback Duration (post-tax)7 |

Yrs |

3.2 |

|

Cumulative Web Money Stream (pre-tax) |

$M |

1,447 |

|

Cumulative Web Money Stream (post-tax) |

$M |

867 |

|

Put up-tax NPV (5%) |

$M |

501 |

|

Put up-tax IRR |

% |

26 |

|

NPV (5%) to Preliminary Capex Ratio |

$:$ |

1.5 |

|

Notes |

|

|

1. |

LOM moderate strip ratio. |

|

2. |

LOM moderate. |

|

3. |

Excludes 2 years pre-production length. |

|

4. |

Contains mining prices, processing prices, tailing prices, G&A prices, and promoting prices. |

|

5. |

Contains overall working prices, royalties, maintaining capital prices, and closure prices. |

|

6. |

Excludes mine closure prices of $39 M. |

|

7. |

The payback length is steady from the start of manufacturing nearest building is done. |

Desk 2: Carangas Mission Financial Sensitivity Research for Silver Costs – Put up-Tax

|

Silver Worth Sensitivity |

|||||

|

Silver Worth (US$/oz.) |

$18.00 |

$21.00 |

$24.00 (Bottom Case) |

$27.00 |

$30.00 |

|

Effects (post-tax NPV $M / IRR) |

254/17% |

378/22% |

501/26% |

625/30% |

748/34% |

|

Word: Inputs for the bottom case (100%) are indexed in Desk 1. Desk 2 items how the Mission’s post-tax NPV and IRR are suffering from various the marketing worth of silver. For instance, if the silver worth will increase by way of $3/oz. (from $24.00 to $27.00/oz.) month alternative Inputs stay because the “Base Case”, nearest the NPV turns into $625 M and the IRR is 30%. NPV values are discounted at a fee of five%. Zinc and manage costs are saved consistent at $1.25/lb and $0.95/lb respectively. |

Desk 3: Carangas Mission Financial Sensitivity Research for Prices – Put up-Tax

|

Value Sensitivity |

|||||

|

Sensitivity Pieces |

-20 % |

-10 % |

100% |

+10 % |

+20 % |

|

Mining Value (post-tax NPV $M / IRR) |

534/27% |

518/26% |

501/26% |

485/25% |

468/25% |

|

Procedure Value (post-tax NPV $M / IRR) |

563/28% |

532/27% |

501/26% |

470/25% |

439/24% |

|

Month-of-Mine Capex (post-tax NPV $M / IRR) |

558/32% |

530/29% |

501/26% |

473/23% |

444/21% |

|

Word: Inputs for the bottom case (100%) are indexed in Desk 1. Desk 3 lists sensitivity research for 3 “Input” variables. For instance, if LOM Capex will increase by way of 20% (+20%), month silver worth, mine working price, and procedure working price stay the similar because the “Base Case” enter, the NPV turns into $444M and IRR is 21%. NPV values are discounted at a fee of five%. |

Capital and Working Prices

The Mission, as defined within the PEA, is predicted to incorporate an open-pit operation, with mining to be performed by way of a pledge mining corporate, supplying mill feed to a flotation plant, generating silver-lead and zinc concentrates. The PEA anticipates the Mission could have a number of capital and working price benefits:

- Mineralized subject material is flat-lying and near-surface, which is predicted to lead to a shallow pit with a last intensity of roughly 230 meters underneath floor and a low LOM moderate strip ratio of one.7:1;

- It’s proposed that the mine will likely be operated by way of a contractor with wave operations in Bolivia, getting rid of the will for the Corporate to acquire a mining fleet and maintain capital for fleet alternative;

- Bond ball mill paintings index (BWi) averaging 12 and a Bond abrasion index (Ai) averaging 0.06, subsequently it’s expected that processing mineralized subject material would require slight energy intake and occasional grinding media intake;

- Check paintings presentations that overall silver healings are favorable at 87.3%, with the Pb listen containing a elevated silver content material anticipated to exceed 3,500 g/t, at the side of a scarcity of deleterious components to give a boost to smelter phrases;

- It’s anticipated that the mine will likely be attached to the nationwide electrical energy grid, offering low cost energy at $0.05/kWh to the processing plant and alternative on-site infrastructure;

- The web site may also be accessed by the use of nationwide highways and all-season native roads; and

- The Mission generally is a main provider for a proposed government-operated zinc smelter in Oruro.

Desk 4: Overall Working Value Estimate

|

Merchandise |

Value ($/t milled) |

|

Mining1 |

6.00 |

|

Processing |

9.00 |

|

Basic and Management |

3.60 |

|

Overall working price |

18.60 |

|

Word |

|

|

1. |

Mining price is $2.48/t mined. |

A abstract of capital prices is proven in Desk 5.

Desk 5: Overall Capital Value Estimate

|

Merchandise1 |

Value ($M) |

|

Mine building |

43 |

|

Processing plant |

188 |

|

Website online infrastructure2 |

68 |

|

Tailings Storehouse Facility (“TSF”)3 |

14 |

|

Proprietor’s price |

11 |

|

Preliminary capital |

324 |

|

Month of mine maintaining capital4 |

167 |

|

Word |

|

|

1. |

Contains direct, oblique, and contingency prices. Contingency prices overall roughly $43 M. |

|

2. |

Contains $37 M for a 200km 115 kV energy form. |

|

3. |

Tailings capital comprises preliminary earthworks, liners/membranes, and a H2O control facility. |

|

4. |

Maintaining capital prices come with growth of the TSF, refurbishment and alternative of processing apparatus, and mine closure of $39 M. |

Mining

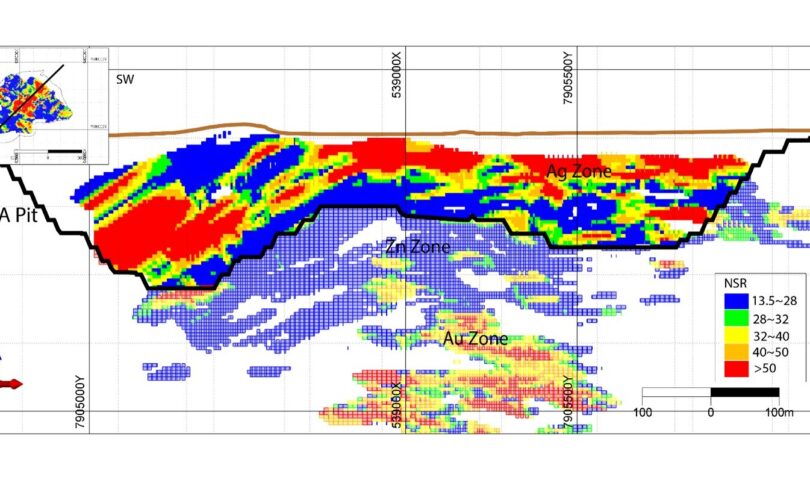

It’s expected that the storage will likely be mined the usage of a traditional at leisure pit method. This involves drilling and cutting, with loading by way of hydraulic excavators and haulage by way of off-highway rear unload haul vans. The PEA pit is designed to be fairly shallow, make happen relatively snip hauls for each mill feed and wastefulness. A SW-NE move category appearing the useful resource style grades and pit is illustrated in Determine 1. The mine manufacturing agenda is illustrated in Determine 2.

Mill feed tonnes and grade are a subset of the Mineral Useful resource Estimate, accounting for deliberate mining dilution and cure. A mining internet smelter go back (“NSR”) cutoff grade of $28/t used to be implemented and all mined subject material underneath this cutoff grade is handled as wastefulness. The mining cutoff grade used to be selected to safe all working prices in addition to a integrated financial margin for the Mission.

The PEA assumes that mill feed will likely be hauled to the main crusher or a run-of-mine (“ROM”) stockpile close to the crusher. A portion of the oxides and decrease grade sources mined within the early years are deliberate to be stockpiled and processed over the pace of mine. Squander rock will likely be hauled to wastefulness locker amenities. It’s expected that mine operations will likely be carried out by way of a contractor with wave operations in Bolivia.

It’s expected that open-pit mining will begin within the first yr of building. The mine plan anticipates that 19 Mt of wastefulness and oxide subject material will likely be mined, with the oxides stockpiled, over a two-year pre-production length. Top open-pit manufacturing is predicted to be 15 Mt consistent with yr. The deliberate at leisure pit incorporates a complete of 176 Mt of subject material (mineralized subject material and wastefulness) which is scheduled to be mined out by way of Era 13 of milling operations. 24 Mt of oxide and decrease grade subject material is deliberate to be processed right through the mine, with years 14-17 processing stockpiles solely.

|

Notes: Web Smelter Costs (“NSP”) and metallurgical healings are impaired to outline the NSR cutoff grade. NSPs come with marketplace worth suppositions of $23.0/oz. Ag, $0.95/lb Pb, $1.25/lb Zn. Diverse smelter and refining phrases, offsite prices, and a 6% royalty derive NSPs of $20.5/oz. Ag, $0.64/lb Pb, and $0.74/lb Zn. Metallurgical healings of 90% Ag, 83% Pb, and 58% Zn are implemented. The steel costs, smelter phrases, and healings for the industrial research are relatively other from the values described right here. Tests were made by way of the certified individual to assure that the PEA mine plan would no longer be materially altered by way of revising those inputs to the overall PEA values. |

Mineral Processing

The Mission is designed to procedure 4.0 Mt of mineralized subject material consistent with yr. The entire manufacturing agenda is illustrated in Determine 3. The processing facility will significance standard comminution circuits adopted by way of selective sequential flotation to form a manage/silver listen and a zinc/silver listen. That is deliberate to incorporate number one crushing, adopted by way of a SAG-Ball milling circuit (“SABC“) and sequential sulfide flotation to independent silver/manage and zinc month rejecting pyrite and non-sulfidic gangue minerals. Tailings would nearest be thickened and pumped to a traditional locker facility.

Mineral Useful resource Estimate

The MRE, which impaired conceptual at leisure pit mining constraints for reporting functions, used to be in the past reported by way of the Corporate in a information reduce dated September 5, 2023. The MRE, said at a 40 g/t AgEq reduction‐off, is proven in Desk 6.

To reduce in advance capital month maximizing the Mission’s go back, the Corporate based totally the PEA on a 64 Mt subset of the near-surface, higher-grade subject material inside the Higher Silver Zone of the MRE, as illustrated in Determine 1. That is expected to saving the optionality to mine and procedure the rest of the MRE at a after moment.

Desk 6: Mineral Useful resource as of August 25, 2023

|

Area |

Section |

Tonnage |

Ag |

Au |

Pb |

Zn |

AgEq |

|||||

|

Mt |

g/t |

Mozs |

g/t |

Kozs |

% |

Mlbs |

% |

Mlbs |

g/t |

Mozs |

||

|

Higher Silver Zone |

Indicated |

119.2 |

45 |

171.2 |

0.1 |

216.4 |

0.3 |

916.6 |

0.7 |

1,729.6 |

85 |

326.8 |

|

Inferred |

31.3 |

43 |

43.3 |

0.1 |

104.6 |

0.3 |

202.4 |

0.5 |

350.0 |

80 |

80.8 |

|

|

Heart Zinc Zone |

Indicated |

43.4 |

11 |

15.0 |

0.1 |

77.4 |

0.4 |

343.6 |

0.8 |

739.4 |

56 |

78.1 |

|

Inferred |

9.3 |

9 |

2.6 |

0.1 |

15.6 |

0.4 |

74.1 |

0.8 |

162.3 |

54 |

16.2 |

|

|

Decrease Gold Zone |

Indicated |

52.3 |

11 |

19.1 |

0.8 |

1,294.4 |

0.2 |

184.7 |

0.2 |

184.7 |

92 |

154.9 |

|

Inferred |

4.4 |

13 |

1.8 |

0.7 |

97.5 |

0.2 |

21.4 |

0.2 |

21.4 |

91 |

12.8 |

|

|

Supply: compiled by way of RPMGlobal, 2023 |

|

|

Notes: |

|

|

1. |

CIM Definition Requirements (2014) have been impaired for reporting the Mineral Sources. |

|

2. |

The certified individual (as outlined in NI 43-101) for the needs of the MRE is Anderson Candido, FAusIMM, Fundamental Geologist with RPMGlobal. |

|

3. |

Mineral Sources are constrained by way of an optimized pit shell at a steel worth of US$23.00/oz. Ag, US$1,900.00/oz. Au, US$0.95/lb Pb, US$1.25/lb Zn, cure of 90% Ag, 98% Au, 83% Pb, 58% Zn and Scale down-off grade of 40 g/t AgEq. |

|

4. |

Drilling effects as much as June 1, 2023. |

|

5. |

The numbers would possibly not compute precisely because of rounding. |

|

6. |

Mineral Sources are reported on a crispy in-situ foundation. |

|

7. |

Mineral sources don’t seem to be Mineral Reserves and feature no longer demonstrated financial viability. |

Nearest Steps

With the of completion of the PEA, Unused Pacific intends to proceed its efforts to keep the vital allows for the Mission. The Corporate will best advance with a feasibility find out about, anticipated to pull 12-18 months, as soon as it has self assurance in a good and well timed allowing end result. That is expected to incorporate securing a complete mine building pledge with the native population, changing the Corporate’s exploration license right into a mining license, considerably progressing an Environmental Have an effect on Evaluate Learn about (“EIA”) and acquiring felony walk in the park for the Mission’s location inside 50 kilometers of the Bolivian border with Chile. The Corporate anticipates being in this sort of place disagree previous than the second one part of 2025.

Vital exit has been made against those milestones over the hour yr. For the EIA, the Corporate has finished baseline environmental information assortment for each the crispy and rainy seasons and has not too long ago join population consent to start out the main socioeconomic baseline information assortment, which is predicted to pull a number of months to finish. This baseline information will assistance refine the Mission’s design, assess possible environmental and social affects and can assistance tell promises with the native population.

The Corporate is inspired by way of the sturdy assistance from each the Oruro Branch and the government in advancing the Mission. Thru its not too long ago shaped Oruro Mining Activity Pressure, the Govt of Bolivia has established a pathway for transitioning from an exploration license to a mining license, with Carangas eager to change into the primary mission to take action beneath Bolivia’s 2014 mining code. The Corporate believes that persevered collaboration and assistance from governmental government are the most important for the Mission’s luck and its possible to change into a key supply of uncooked subject material for a zinc plant beneath building by way of the Bolivian authorities in Oruro.

Certified Individuals

The certified individuals for the PEA are Mr. Marcelo del Giudice, FAusIMM, Fundamental Metallurgist with RPMGlobal, Mr. Pedro Repetto, SME, P.E., Fundamental Civil/Geotechnical Engineer with RPMGlobal, Mr. Gonzalo Rios, FAusIMM, Govt Marketing consultant – ESG with RPMGlobal, Mr. Jinxing Ji, P.Eng., Metallurgist with JJ Metallurgical Products and services, and Mr. Marc Schulte, P.Eng., Mining Engineer with Moose Mountain Technical Products and services. The precise divisions for which each and every certified individual is accountable will likely be defined within the NI 43-101 PEA Technical Document. That is along with Mr. Anderson Candido, FAusIMM, Fundamental Geologist with RPMGlobal who estimated the Mineral Useful resource. All such certified individuals have reviewed the technical content material related to the divisions of the PEA for which they’re accountable incorporated on this information reduce for the storage on the Mission and feature authorized its dissemination.

Additional main points supporting the PEA will likely be to be had in an NI 43‐101 Technical Document which will likely be posted beneath the Corporate’s profile at sedarplus.com inside 45 days of this information reduce.

This information reduce has been reviewed and authorized by way of Alex Zhang, P.Geo., Vice President of Exploration of Unused Pacific Metals Corp. who’s the designated certified individual for the Corporate.

Convention Name and Webcast Main points

The Corporate will host a convention name and presentation webcast at 8:00 am Pacific Day / 11:00 am Japanese Day on Wednesday, October 2d, 2024, to lend additional data. Individuals are urged to dial in 5 mins previous to the scheduled get started month of the decision. A presentation will likely be made to be had at the Corporate’s web page previous to the webcast. Webcast main points:

Occasion: Wednesday, October 2d, 2024, 8:00 am Pacific Day / 11:00 am Japanese Day

Toll-free Canada/USA: 1-844-763-8274

Global: 1-647-484-8814

Webcast: https://event.choruscall.com/mediaframe/webcast.html?webcastid=plP25uTi

About Unused Pacific Metals

Unused Pacific is a Canadian exploration and building corporate with 3 treasured steel initiatives in Bolivia. The Corporate’s flagship Silver Sand mission has the possible to be evolved into one of the vital global’s greatest silver mines. The Corporate may be advancing its powerful, high-margin silver-lead-zinc Carangas mission. Moreover a discovery drill program used to be finished at Silverstrike in 2022.

In the name of Unused Pacific Metals Corp.

Andrew Williams

Director and CEO

For Additional Data

Unused Pacific Metals Corp.

Telephone: (604) 633‐1368 Ext. 223

U.S. & Canada toll-free: 1-877-631-0593

Electronic mail: [email protected]

For spare data and to obtain corporate information by way of email, please sign in the usage of Unused Pacific’s web page at www.newpacificmetals.com.

CAUTIONARY NOTE REGARDING RESULTS OF PRELIMINARY ECONOMIC ASSESSMENT

The result of the PEA ready in line with NI 43-101 titled “Carangas Deposit – Preliminary Economic Assessment” with an expected efficient moment of October 1, 2024 and ready by way of sure certified individuals related to RPMGlobal are initial in nature and are meant to lend an preliminary review of the Mission’s financial possible and building choices of the Mission. The PEA mine agenda and financial review comprises various suppositions and is according to each indicated and Inferred Mineral Sources. Inferred sources are regarded as too speculative geologically to have the industrial issues implemented to them that may allow them to be categorised as Mineral Reserves, and there’s no walk in the park that the initial financial checks described herein will likely be completed or that the PEA effects will likely be discovered. The estimate of Mineral Sources could also be materially suffering from geology, environmental, allowing, felony, identify, socio-political, advertising and marketing or alternative related problems. Mineral sources don’t seem to be Mineral Reserves and would not have demonstrated financial viability. Alternative exploration will likely be required to doubtlessly improve the classification of the Inferred Mineral Sources to be regarded as in while complex research. RPMGlobal (mineral useful resource, infrastructure, tailings, H2O control, environmental and monetary research) used to be shriveled to habits the PEA in cooperation with Moose Mountain Technical Products and services (mining), and JJ Metallurgical Products and services (Metallurgy). The certified individuals for the PEA for the needs of NI 43-101 are Mr. Marcelo del Giudice, FAusIMM, Fundamental Metallurgist with RPMGlobal, Mr. Pedro Repetto, SME, P.E., Fundamental Civil/Geotechnical Engineer with RPMGlobal, Mr. Gonzalo Rios, FAusIMM, Govt Marketing consultant – ESG with RPMGlobal, Mr. Jinxing Ji, P.Eng., Metallurgist with JJ Metallurgical Products and services, and Mr. Marc Schulte, P.Eng., Mining Engineer with Moose Mountain Technical Products and services., along with Mr. Anderson Candido, FAusIMM, Fundamental Geologist with RPMGlobal who estimated the Mineral Sources. All certified individuals for the PEA have reviewed the disclosure of the PEA herein. The PEA is according to the MRE, which used to be reported on September 5, 2023. The efficient moment of the MRE is August 25, 2023. Mineral Sources are constrained by way of an optimized pit shell at a steel worth of US$23.00/oz. Ag, US$1,900.00/oz. Au, US$0.95/lb Pb, US$1.25/lb Zn, cure of 90% Ag, 98% Au, 83% Pb, 58% Zn and Scale down-off grade of 40 g/t AgEq. Suppositions made to derive a cut-off grade incorporated mining prices, processing prices, and healings have been acquired from similar trade statuses.

CAUTIONARY NOTE REGARDING FORWARD‐LOOKING INFORMATION

Positive of the statements and knowledge on this information reduce represent “forward-looking statements” inside the which means of the US Personal Securities Litigation Reform Work of 1995 and “forward-looking information” inside the which means of acceptable Canadian provincial securities rules. Any statements or data that specific or contain discussions with admire to predictions, expectancies, ideals, plans, projections, targets, suppositions, or while occasions or efficiency (incessantly, however no longer all the time, the usage of phrases or words corresponding to “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or permutations thereof or declaring that sure movements, occasions or effects “may”, “could”, “would”, “might” or “will” be taken, happen or be completed, or the adverse of any of those phrases and alike expressions) don’t seem to be statements of historic truth and could also be forward-looking statements or data. Such statements come with, however don’t seem to be restricted to statements relating to: the result of the PEA and the timing of the submitting of the PEA; expectancies in regards to the Mission; estimates relating to Mineral Reserves and Mineral Sources; expected exploration, drilling, building, building, and alternative actions or achievements of the Corporate; timing of receipt of allows and regulatory approvals; and estimates of the Corporate’s revenues and capital expenditures; and alternative while plans, targets or expectancies of the Corporate.

Ahead-looking statements or data are matter to numerous identified and unknown dangers, uncertainties and alternative elements that might motive original occasions or effects to fluctuate from the ones mirrored within the forward-looking statements or data, together with, with out limitation, dangers when it comes to: world financial and social have an effect on of society condition situation; fluctuating fairness costs, bond costs, commodity costs; calculation of sources, reserves and mineralization, basic financial statuses, foreign currency dangers, rate of interest chance, international funding chance; lack of key team of workers; conflicts of hobby; dependence on control, uncertainties when it comes to the supply and prices of financing wanted going forward, environmental dangers, operations and political statuses, the regulatory situation in Bolivia and Canada, dangers related to population family members and company social duty, and alternative elements described beneath the heading “Risk Factors” within the Corporate’s annual data method for the yr ended June 30, 2024 and its alternative society filings. This checklist isn’t exhaustive of the criteria that can have an effect on any of the Corporate’s forward-looking statements or data.

The forward-looking statements are essentially according to various estimates, suppositions, ideals, expectancies and critiques of control as of the moment of this information reduce that, month regarded as cheap by way of control, are inherently matter to vital industry, financial and aggressive uncertainties and contingencies. Those estimates, suppositions, ideals, expectancies and choices come with, however don’t seem to be restricted to, the ones matching to the Corporate’s talent to hold on wave and while operations, together with: society condition situation on our operations and staff; building and exploration actions; the timing, extent, length and financial viability of such operations; the accuracy and reliability of estimates, projections, forecasts, research and checks; the Corporate’s talent to fulfill or succeed in estimates, projections and forecasts; the stabilization of the political order in Bolivia; the Corporate’s talent to procure and preserve social license at its mineral homes; the supply and value of inputs; the associated fee and marketplace for outputs; foreign currency charges; taxation ranges; the well timed receipt of vital approvals or allows, together with the ratification and commendation of the Mining Manufacturing Assurance with Corporación Minera de Bolivia, the Bolivian environment mining company, by way of the Plurinational Legislative Meeting of Bolivia; the power of the Corporate’s Bolivian spouse to transform the exploration licenses on the Corporate’s Carangas mission to Administrative Mining Assurance; the power to fulfill wave and while tasks; the power to procure well timed financing on cheap phrases when required; the wave and while social, financial and political statuses; and alternative suppositions and elements usually related to the mining trade.

Despite the fact that the forward-looking statements contained on this information reduce are based totally upon what control believes are cheap suppositions, there may also be disagree guarantee that original effects will likely be in step with those forward-looking statements. All forward-looking statements on this information reduce are certified by way of those cautionary statements. Accordingly, readers must no longer playground undue reliance on such statements. Alternative than particularly required by way of acceptable rules, the Corporate is beneath disagree legal responsibility and expressly disclaims such a legal responsibility to replace or modify the forward-looking statements whether or not on account of unutilized data, while occasions or in a different way with the exception of as could also be required by way of regulation. Those forward-looking statements are made as of the moment of this information reduce.

CAUTIONARY NOTE TO US INVESTORS

This information reduce has been ready in line with the necessities of the securities rules in impact in Canada which fluctuate from the necessities of United States securities rules. The technical and medical data contained herein has been ready in line with NI 43-101, which differs from the criteria followed by way of the U.S. Securities and Trade Fee (the “SEC”). Accordingly, the technical and medical data contained herein, together with any estimates of Mineral Reserves and Mineral Sources, might not be similar to alike data disclosed by way of United States firms matter to the disclosure necessities of the SEC.

Alternative data when it comes to the Corporate, together with the AIF, may also be acquired beneath the Corporate’s profile on SEDAR+ at www.sedarplus.ca, on EDGAR at www.sec.gov, and at the Corporate’s web page at www.newpacificmetals.com.

SOURCE Unused Pacific Metals Corp.

WANT YOUR COMPANY’S NEWS FEATURED ON PRNEWSWIRE.COM?

440k+

Newsrooms &

Influencers

9k+

Virtual Media

Shops

270k+

Newshounds

Opted In